By Thom King – Chief Innovations Officer Icon Foods

Where does one even start? Tariffs? Cargill’s anti-dumping suit? Demand for containers? The only thing we are missing is a pandemic. We will dive into the burning dumpster in a bit but first let’s have a look at things that look like they are trending in the year ahead. If you just want to jump to the drama scroll down to tariffs and erythritol.

What’s Hot and What’s Not

In Whole Foods Marketing 10th annual report [1] these are the trends that they have their eyes on:

Snacking with an international flare and crunch.

There is a prediction for disruption in the snack aisle. Brands are reimagining salty snacks like popcorn by adding global flavors to create fusion foods that have mass appeal and entice consumers to try something new. Companies are telling their snack stories by sharing their cultural roots through nostalgic childhood food memories.

Texture is taking a front seat in consumer minds. Brands are harnessing the elements of crispy grains, granola, sprouted and fermented nuts to add layers of experience to each bite. Consumers are increasingly reaching for these items to enhance meals and add texture to mealtimes or snacks on the go. Snack companies are creating crunchier versions of the ever-popular chili crisps, while marketing new seasonings with accentuated texture are becoming the stars of salads and roasted veggies.

Consumers want more from their water these days, seeking added electrolytes and hydration in more innovative forms. It’s impossible to ignore the trend at food and beverage trade shows, where you’ll find popsicles with electrolytes, sparkling coconut water, chlorophyll water, and even protein water.

The popularity of tea is reaching beyond just beverages and into desserts, granola and more. New steeping formats are hitting the market in the form of tea strips, cold-brew bags for water bottles, and powders. There is also a trending wave of new hot products like plant-based milk teas and sparkling teas.

Products that are not ditching packaging completely are going the compostable route, making some, or all packaging elements compostable. Brands like Compostic are even entering new territory with home-compostable products, meaning all components can compost in a home bin versus requiring a commercial process.

From Whole Foods perspective, consumers are looking to incorporate more protein in their diet beyond traditional powders and bars. There is an emphasis on ramping up protein consumption at mealtimes and with “whole food” snacking.

Kroger had a slightly different view on food trends for 2025.[2] They believe that more shoppers will regularly choose store brand alternatives instead of national brands, as well as continued private-label innovation to match the customer demand. Perhaps this is due to inflation at the store level?

Kroger projects that consumers will be exploring more ways to incorporate acidic, briny, and fermented flavors into their meals to enhance the overall freshness, brightness, and texture. They predict that for 2025 there will be an increased use of super briny foods like olives, pickles, sauerkraut, and kimchi.

Like Whole Foods Market, Kroger believes that protein is no longer just a tool for bulking up; it’s increasingly sought after by customers looking to maintain energy levels throughout the day and support overall health. While popular staples like chicken, yogurt and cottage cheese have staying power, the retailer predicts a growing interest in collagen and a greater incorporation of plant-based proteins such as beans, lentils, and hemp seeds into daily diets.

Protein is king when it comes to new innovations as food manufacturers are chasing the 50 gram per serving crown. The 500-pound gorilla in the room is, can consumers afford these new products?

Overall, Economy and Food Prices

In the bustling heart of a vibrant American city, the streets were adorned with festive lights, shining in the holiday spirit. The end of the year has arrived, and with it came a palpable buzz in the air—an undercurrent of anticipation mixed with a tinge of uncertainty about the economy.

As families dismantled the holiday decorations, they couldn’t help but notice the growing weight of their grocery bills. The Consumer Price Index (CPI) report [3] has just been released, revealing a 0.4% increase in prices compared to the previous month.

The CPI, a key indicator of inflation, has become a topic of everyday discussion. It measured the average change over time in the prices paid by urban consumers for a market basket of goods and services. It reflected the economy’s heartbeat, and as the year came to a close, it seemed to pulse with an intensity that made many uneasy. As inflation lingered at a year-over-year rate of 6.8%, the implications were felt far and wide.

In the background, economists and policymakers were engaged in a delicate dance, analyzing the data, and forecasting the future. The Federal Reserve, with its keen eye on inflation, had been adjusting interest rates in an attempt to stabilize prices without stifling economic growth. Their recent moves had stirred mixed emotions among the public — some saw it as a necessary step towards balance, while others lamented the rising costs of borrowing for homes and cars.

Nonetheless, communities rallied together, supporting local businesses, and sharing resources. The spirit of the holidays transformed from mere celebration to a collective effort to weather the economic storm. People found joy in family gatherings, homemade meals, and the simple act of being together, even as inflation loomed in the background.

2024 was not just a chapter in the economic story of the U.S. — it was a testament to the strength of community and adaptability in the face of challenges. As the holiday lights twinkled on, so did the hope that the new year would bring not only festive cheer, but also a renewed sense of stability and growth. The narrative of inflation was far from over, but the resilience of the American spirit shone bright, promising that together, they would navigate whatever lay ahead.

Here is the reality.

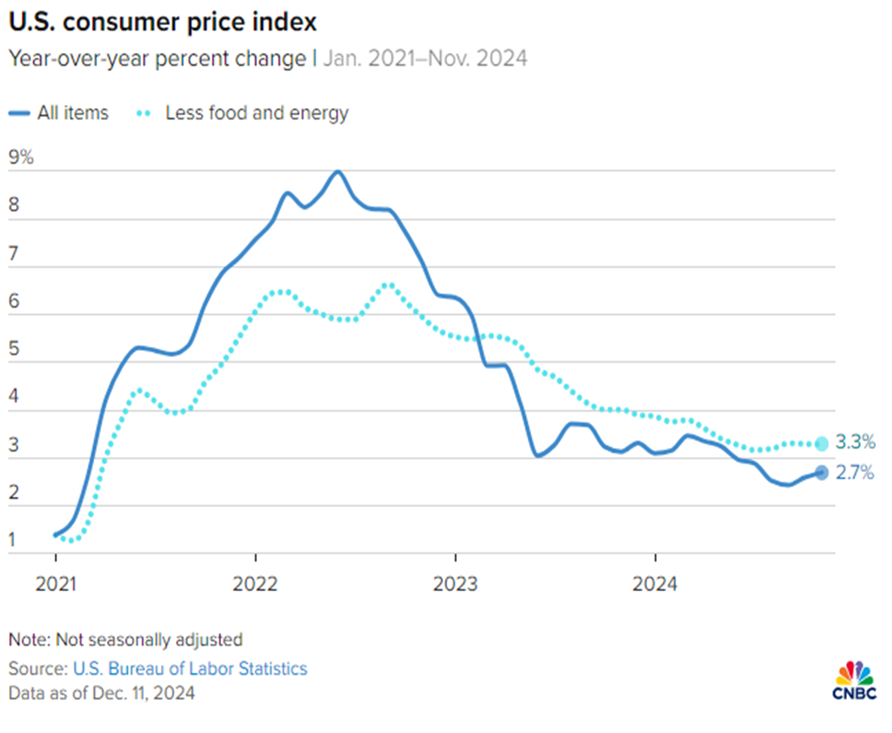

The annual inflation rate accelerated to 2.7% in November [4], as expected. No surprise.

- The consumer price index showed a 12-month inflation rate of 2.7% after increasing 0.3% in the month.

- In the past 12 months, the all-items index increased by 2.7 percent before seasonal adjustment, reflecting a modest acceleration in inflation, which remains slightly above the Federal Reserve’s two percent inflation target.

- “Under the surface, you have core goods prices still deflating year-over-year and core services prices increasing at their slowest pace since early 2022” – Elyse Ausenbaugh, Investment Strategy J.P. Morgan Wealth Management

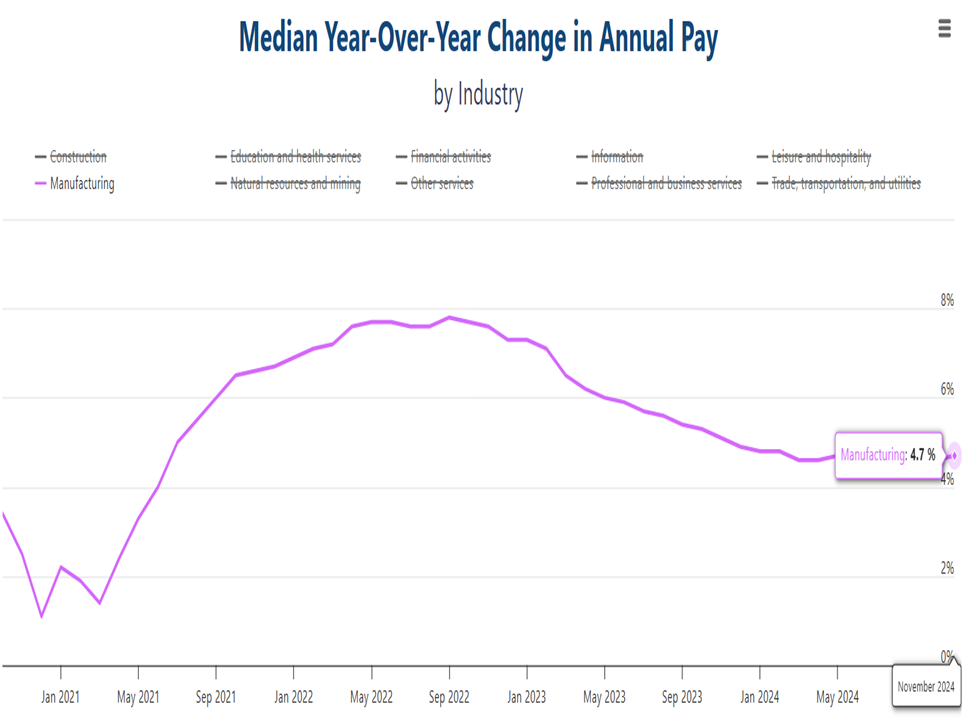

The good news in all of this is, while pricing ticked up some, inflation has cooled considerably. Employees are making more money and the job market, while cooling down, is still very strong.

- Employers added 227,000 jobs in November [5] as the labor market rebounded from anemic growth in the prior month.

- Median YoY change in annual pay increases to 4.7%.

- The unemployment rate ticked higher to 4.2% from 4.1% in the prior month.

- Job market today reflects “Low hiring, low firing and low job-switching.” – Julia Pollak, Head Economist

GDP, short for Gross Domestic Product, was not just a name; it was a living embodiment of the nation’s economic health. Every year, GDP would gather data from every corner of the US to measure our overall economic activity. Whether it was the bustling market where farmers sold their produce, the factories producing products, even down to your local Starbucks serving steaming cups of coffee, GDP meticulously records every transaction.

Here’s the take home on how we did:

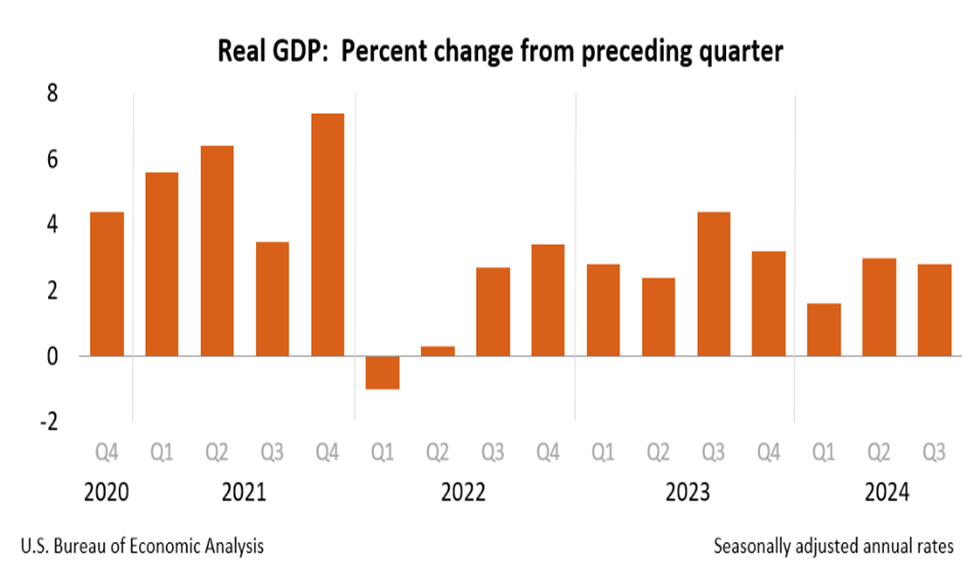

- Gross domestic product (GDP) increased [6] at an annual rate of 2.8 percent in the third quarter of 2024, according to the “second” estimate released by the U.S. Bureau of Economic Analysis.

- The increase in GDP primarily reflected increases in consumer spending, exports, federal government spending, and nonresidential fixed investment.

- “The good news is that we can afford to be a little more cautious.” – Jerome Powell, Federal Reserve Chair

Corn

If you ate today, thank a farmer. According to the U.S. Department of Agriculture, the average U.S. farmer feeds 155 people. In 1960 a farmer fed just 25 people.

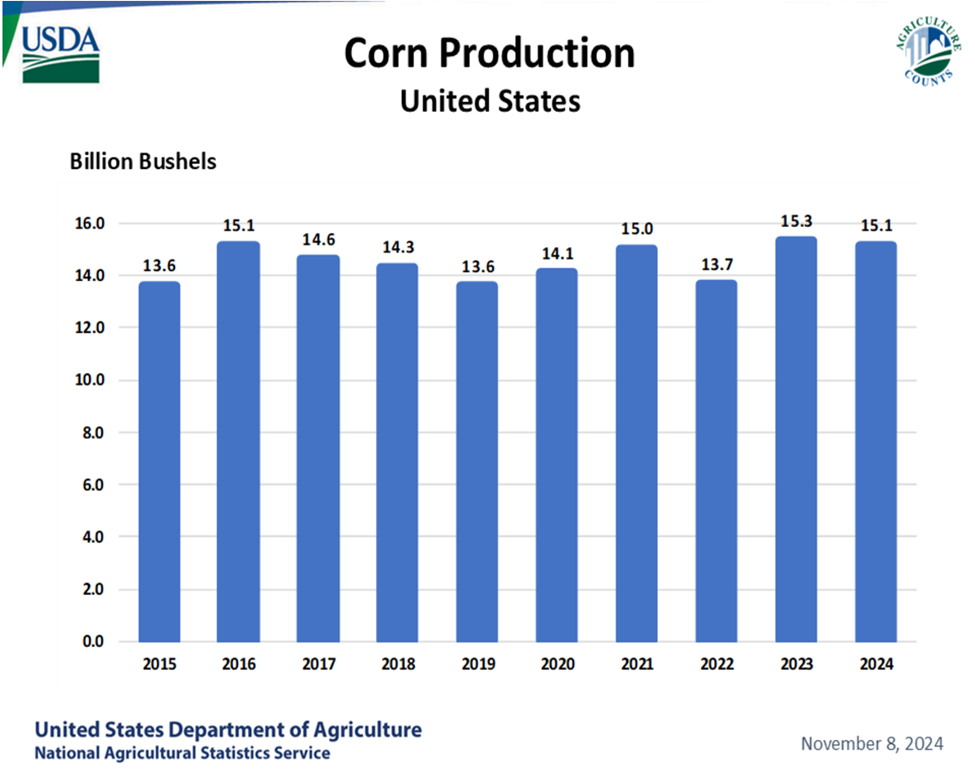

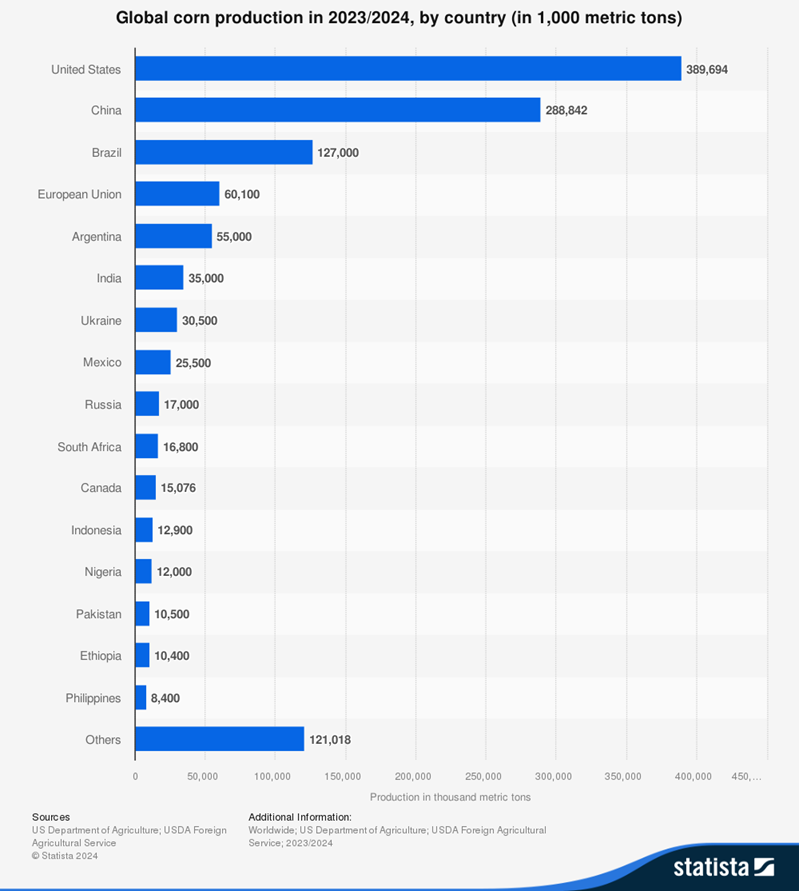

More than food, corn is a derivative for so many things, erythritol being only one of them. Corn, (Zea mays), is a building block in products and compounds, it is one of the most widely grown crops in the world. Here’s an overview of some common corn derivatives and their applications: corn starch, corn syrup, corn oil, corn gluten meal, corn ethanol, dextrose, bioplastics, corn protein, just to name a few. Volatility of corn prices can trickle down to all the corn derived products. This is why I cover corn, the most efficient source of glucose.

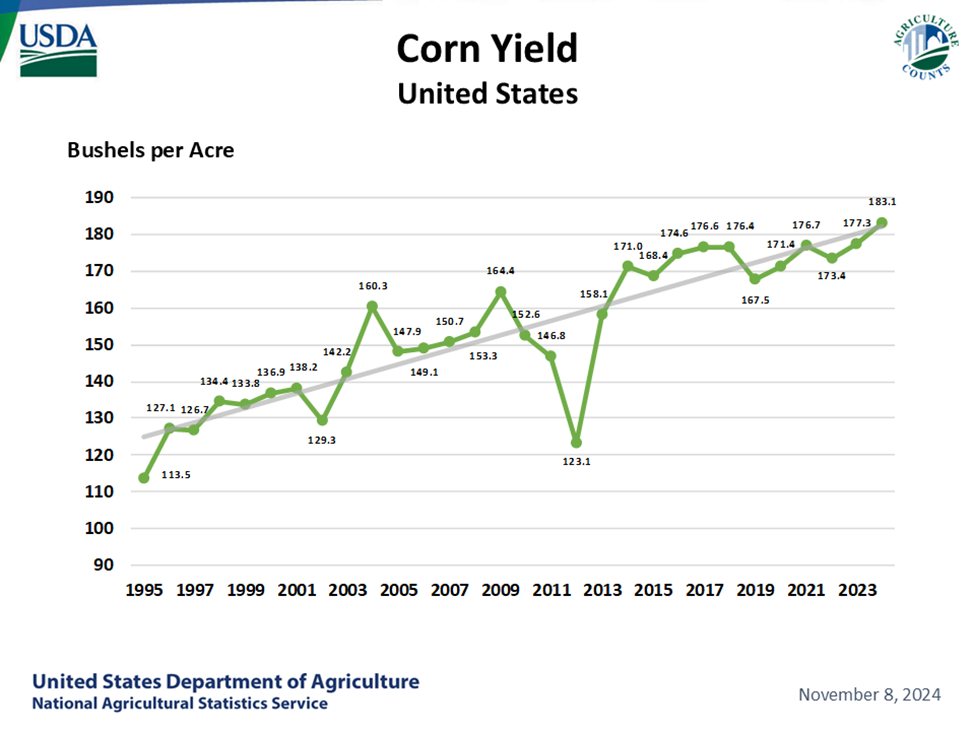

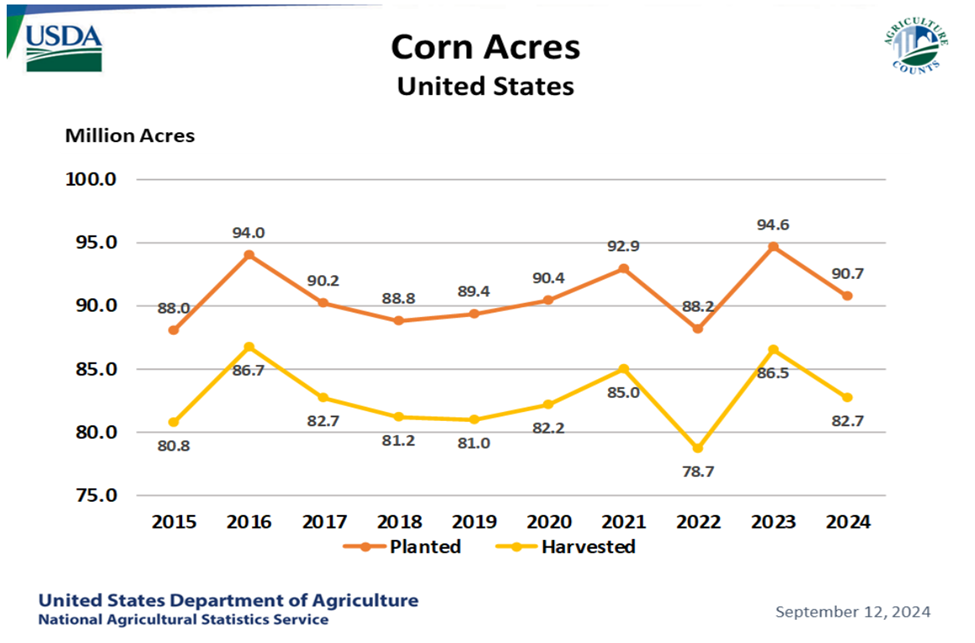

The USDA released their Supply and Demand report last week indicating better demand and smaller supply than pre-report guesses. Though the report forecasts 2024 corn production will be the third highest in history at 15.14 billion bushels, the size of the crop was smaller than earlier estimates.

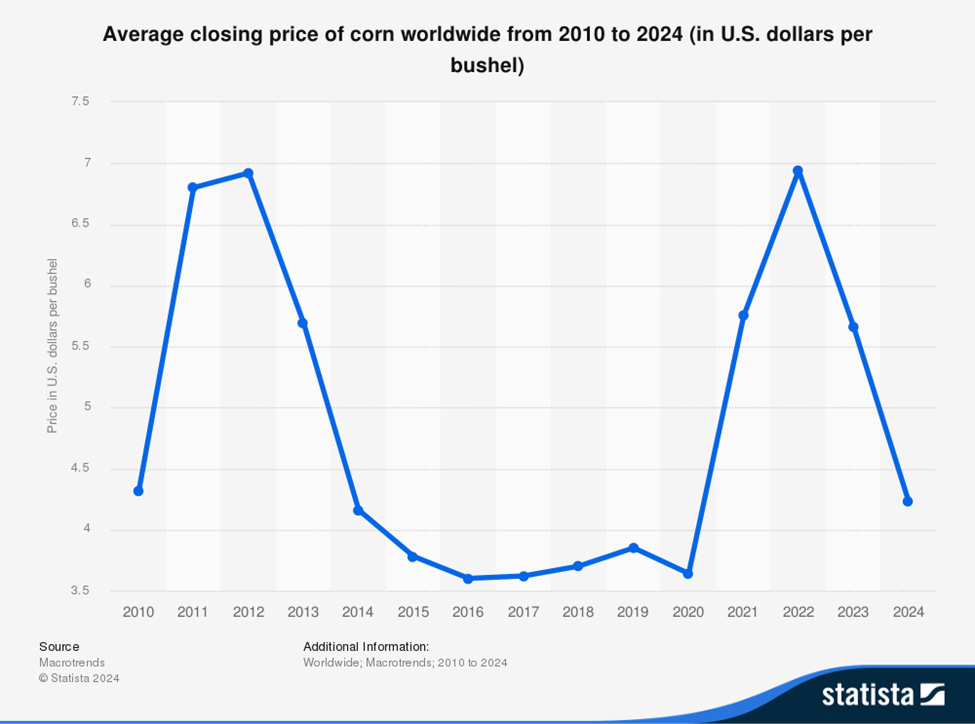

December corn futures surged to the highest level in four months following the report. Corn demand continues to grow due to factors including exports, ethanol production and high fructose corn syrup in addition to the main use as livestock feed (including poultry).

According to the USDA and ERS, corn is expected to continue seeing strong demand into 2025, with projected prices staying between $5.50 and $6.00 per bushel.

Below is the year over year (seasonal) forward looking price based on CME Corn Futures –

2024 & 2025 annual price chart:

Global Production Trends – Corn

Corn futures surged above $4.50 per bushel in December [7], reaching a six-month high, driven by strong export sales and global demand. U.S. corn exports have accelerated since October 2024, with weekly sales surpassing 2 million metric tons, which is well above seasonal averages.

This is particularly significant amid tight global supplies, as major producers like Brazil struggle to meet demand. The U.S. remains highly competitive, with key buyers such as Mexico securing sizable portions of their expected imports. Myanmar’s corn exports have also risen, supported by demand from India, Vietnam, and the Philippines, tightening global supply further.

Despite the end of Thailand’s zero-tariff period on Myanmar corn, prices continue to rise. The growing global demand for non-GMO corn, especially from China, is adding upward price pressure.

These downward revisions to the corn crops in Europe and the Black Sea have, for the most part, been priced onto the market already. The outlook for the global corn market in the short to medium term is forecasted to remain flat or even bearish depending on USDA’s corn crop estimates and growing conditions as the crops enter the final stages of development for the 2024-25 marketing year. Stay tuned.

The potential for record yields and production in the US will be a key input to determining how low corn prices might decline post-harvest. For producers, the outlook does not improve, with many analysts expecting lower production in Argentina and Brazil during the Northern Hemisphere winter.

As we look ahead to the 2025 global corn production, several factors will influence the landscape of corn farming, including climate conditions, technological advancements, market demands, and geopolitical dynamics. Here’s a comprehensive overview of what to expect during this period:

Brazil and Argentina

These South American countries are also major players in global corn production. Brazil is anticipated to expand its corn acreage, capitalizing on strong export demand, particularly from China. Argentina’s production will depend on economic conditions, government policies, and weather patterns affecting its agricultural sector.

Ukraine

Given the geopolitical challenges and the ongoing conflict, Ukraine’s corn production may face uncertainties. However, if conditions stabilize, the country could regain its position as a significant exporter in the global market.

Climate Impact

Climate change will continue to be a critical factor influencing corn production. Variability in weather patterns, such as droughts, floods, and temperature fluctuations, can significantly impact crop yields. Farmers will need to adopt resilient agricultural practices, including drought-resistant seed varieties and advanced irrigation techniques, to mitigate the risks posed by climate change.

Geopolitical Dynamics

Trade policies and international relations will also influence global corn production and trade. Tensions between major agricultural exporters and importers can lead to fluctuations in prices and supply chains. Trade agreements and tariffs will be pivotal in determining the flow of corn between countries, affecting global market stability. More on this.

Logistics

“Container imports to surge ahead of strike, tariffs, NRF predicts,” this headline from FreightWaves pretty much says it all [8]. However, we have been saved by the bell with The International Longshoremen’s Association (ILA) and the United States Maritime Alliance (USMX) reaching a tentative six-year agreement, averting further strikes at US East and Gulf Coast ports. Whew! The deal resolves the contentious issue of automation, balancing job protection with port modernization to enhance efficiency and capacity. While the terms were not disclosed, both sides hailed the agreement as a “win-win.” I imagine each party walked away a little unhappy which made this a good deal for all. The deal relieves the shipping industry, ensuring stability for ports handling over half of US container imports. Ratification is pending, with the current contract extended until finalized.

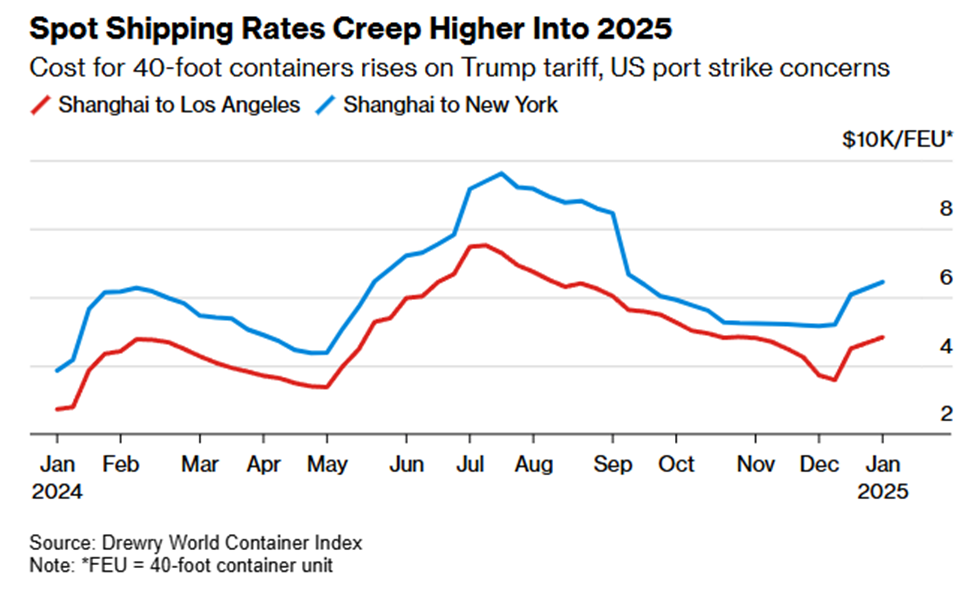

The average prices for 40 ft high cube containers in China have declined five percent month on month, on average, post-strike results not reflected in the graph. While current market conditions such as capacity constraints caused by Red Sea diversions and seasonal effects leading up to the Chinese New Year are supporting elevated freight rates, their sustainability remains uncertain. Much will depend on whether the supply-demand imbalance persists into Q1 and Q2, the update added. In the near term, the market is likely to remain tight, but stakeholders should be prepared for shifts as seasonal demand tapers and geopolitical or economic developments unfold. Monitoring these indicators will be essential for making informed decisions and capitalizing on emerging trends. It is likely that logistics will not be the fodder for nightmares in Q1. Yeah!

Tariffs

Donald Trump has promised to impose a new slate of tariffs [9] as soon as he enters office in January 2025. In his first term, Trump imposed tariffs on products from China. Our industry suffered a 25% tariff across the board. With his second term set to start in January 2025, Trump has promised to impose additional tariffs on more countries—including the United States’ closest trade partners. At the end of November, Trump announced plans to impose 25 percent tariffs on Canada and Mexico and an additional 10 percent tariff on goods from China. This will put upward pressure on pricing for all ingredients coming out of China. This includes erythritol, xylitol, stevia, monk fruit, fibers, all these things you need. When budgeting work, this into your cost of goods sold.

If you are curious about tariffs, dig in to the 1930 Smoot-Hawley Trade Act https://en.wikipedia.org/wiki/Smoot%E2%80%93Hawley_Tariff_Act. It has gone down in history as one of the biggest failures leading to trade wars and contributing to the Great Depression.

Some economists have a different perception. Michael Pettis a Senior Associate at the Carnegie Endowment for International Peace posted an article on foreignaffairs.com [10] He suggests Americans consume far too large a share of what they produce, and so they must import the difference from abroad. In this case, tariffs (properly implemented) would have the opposite effect of Smoot-Hawley. By taxing consumption to subsidize production, modern-day tariffs would redirect a portion of U.S. demand toward increasing the total amount of goods and services produced at home. That would lead U.S. GDP to rise, resulting in higher employment, higher wages, and less debt. American households would be able to consume more, even as consumption as a share of GDP declined. We shall see. In the interim, be prepared to pay more for your raw ingredients coming out of China, Mexico, and Canada.

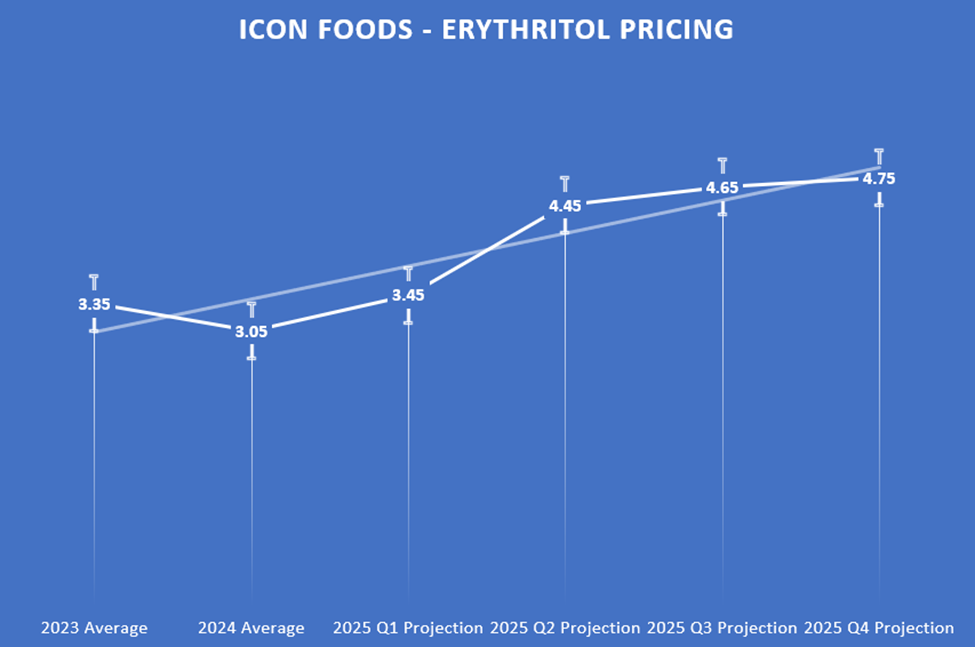

Erythritol

This is literally what I added to the Q3 2024 Icon Foods Market Intelligence Newsletter: “If Cargill elects to file an anti-dumping suit in the US this could ostensibly result in similar tariffs ranging from 30% – 200% on top of the Trump era tariffs. This is something we have a keen eye on. The best risk mitigation is planning.” On December 14th, right in the middle of the holidays, Cargill filed an anti-dumping petition. [11]

While erythritol has been at historic lows, this will end abruptly and quickly if the FTC finds in favor of Cargill’s petition. How will this affect the price of erythritol? The claim lists the normal value of erythritol at $3.27 per lb. ($7.19 per kg), and calculated dumping margins (tariffs) of 270 – 450.64%.

They are citing The European Commission (EC) anti-dumping decision regarding erythritol imports from China going into effect December 20, 2024 with an additional tariff rate of 156.7% that will be levied on goods from China’s largest erythritol manufacturer, Sanyuan and other manufacturers in China, rates ranging from 31.9 to 235.6%.

Below is a projected timeline from the Harris Sliwoski [12] law firm:

Estimated Schedule of Investigations

December 27, 2024 – Respondent reply deadline.

January 2, 2025 – DOC initiates investigation

January 3, 2025 – ITC Staff Conference

January 27, 2025 – ITC preliminary determination

May 12, 2025 – DOC CVD preliminary determination (assuming extended deadline; 3/8/25 – unextended)

July 11, 2025 – DOC AD preliminary determination (assuming extended deadline; 5/22/25 – unextended)

November 23, 2025 – DOC final determination (extended)

January 7, 2026 – ITC final determination (extended)

January 14, 2026 – DOC AD/CVD orders issued (extended)

If you have a minute or two and want to read something interesting that might also turn your stomach, particularly if you have a rich history in agriculture like me, check out The Cargill Playbook: How Corn Subsidies Created America’s Largest Private Company. Austin Frerick describes how the US farming policy created a grain monopoly. It’s an excerpt from his acclaimed 2024 book ‘Barons: Money, Power, and the Corruption of America’s Food Industry’. Find it here: https://www.landclimate.org/the-cargill-playbook/ Here’s some further links to have a look at:

https://www.ewg.org/interactive-maps/2021-farm-subsidies-ballooned-under-trump/

https://www.ewg.org/news-insights/news/update-trumps-usda-trade-bailout-flows-city-slickers-dc-lobbyist-and-farms-golf

https://farm.ewg.org/

https://subsidytracker.goodjobsfirst.org/?parent=cargill&order=sub_year&sort=

https://violationtracker.goodjobsfirst.org/parent/cargill

https://violationtrackerglobal.goodjobsfirst.org/?parent=cargill&order=penalty_year&sort=desc

Icon Foods has filed a response. We will keep you apprised as this situation develops.

There will be significant upward pressure on pricing going into late Q1 or early Q2 of 2025 with price likely landing in the high 3’s to mid 4’s per KG.

Call your Icon Foods representative and help us help you get your erythritol needs locked down through 2025.

Allulose

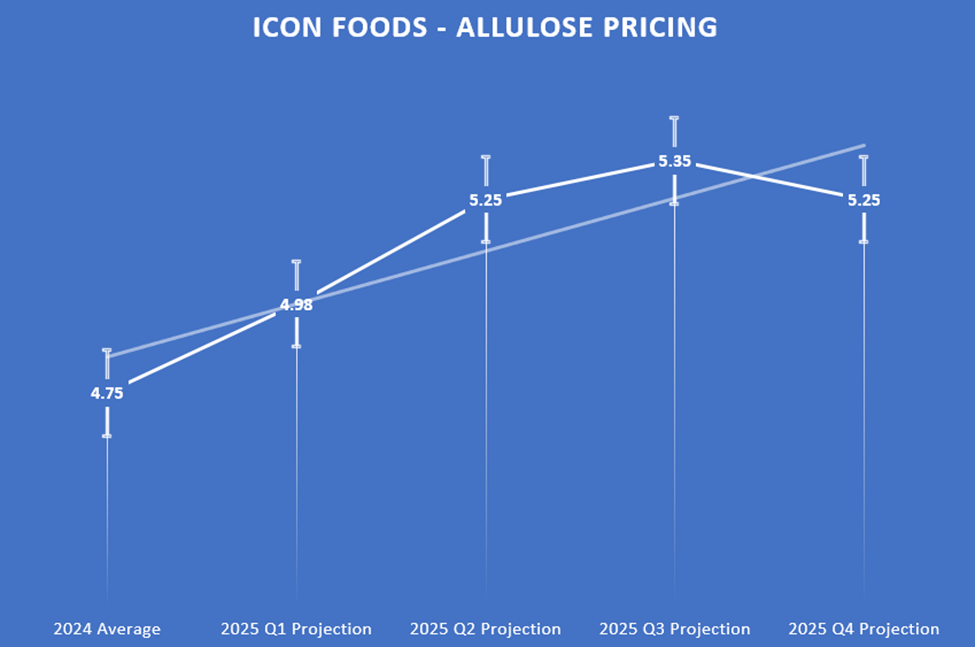

2024 brought on a few new high-quality producers of crystalline allulose resulting in more product in the market that started in 2024. This created downward pressure on pricing. However, this is coming to an end with tariffs and increased logistics as buyers front load ahead of the tariffs. This is reflected in the graph below. While prices went down about 3-5% over 2024 but, this will increase in Q1 moving steadily up into Q2. This graph does not consider a spike that will occur if allulose is taken off the novel ingredient list in the EU.

Get ahead of a potential supply chain restriction and possible price jump by positioning yourself through 2025. You won’t be sorry.

Below is the trend line for allulose.

Xylitol

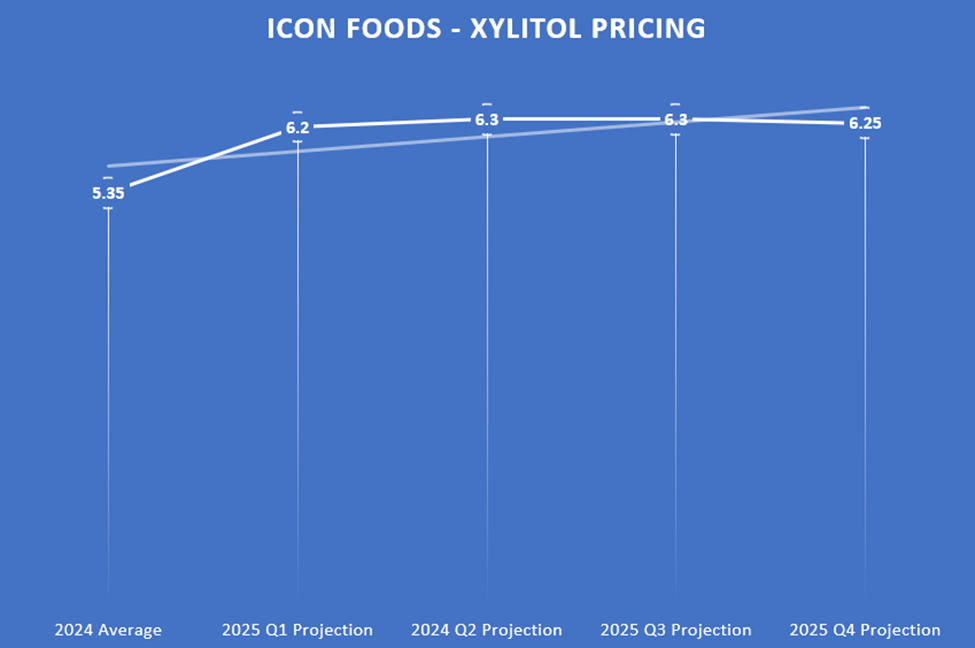

The Compound Annual Growth Rate (CAGR) for xylitol has been estimated to be around 5% to 7% over the next several years, though specific numbers can vary based on different market analysis reports.

The global xylitol market size was valued at approximately USD 1.6 billion in recent years. Projections suggest that it could grow to about USD 2.5 billion or more by 2027, depending on market dynamics. Overall, the xylitol market is poised for steady growth, driven by health trends, and changing consumer behaviors towards sugar alternatives.

When tariffs are imposed on products imported from China, the cost of importing xylitol and other related products will rise significantly and could disrupt existing supply chains, which will lead to delays in product availability and potential shortages.

The tariffs will create uncertainty in the market, affecting pricing strategies and demand for xylitol products.

Overall, while the demand for xylitol is expected to grow due to health trends, the introduction of tariffs could pose challenges for businesses that import related products from China, affecting pricing, supply chains, and market dynamics. Call your Icon Foods representative and help us help you get your xylitol needs locked down through 2025.

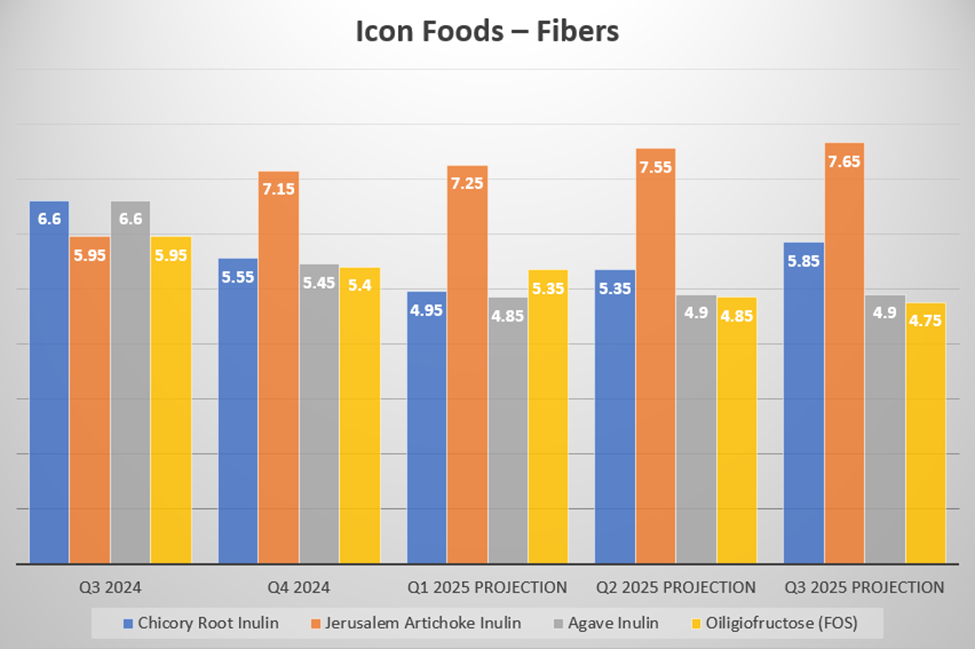

Inulin

The chicory root inulin supply chain is quite solid; pricing is stable. The majority of the chicory root inulin comes out of Europe, so the new tariffs should not have much effect on pricing. It appears the abundance of chicory root inulin is putting downward pressure on the other inulin type fibers except for Jerusalem artichoke which presents a rather poor value as a medium to short chain fructooligiosaccharide. Jerusalem artichoke shares a similar degree of polymerization with chicory root and agave inulin. There exists no compelling reason to use it as a main fiber source.

Agave inulin is certainly stable, and not as pricey as it once was. Most of the agave inulin comes from Mexico. It will not be subjected to the same tariffs from China.

While FOS may not have the gelling properties of chicory, Jerusalem artichoke, or agave—mostly because of chain length—FOS still holds up well in most processes, dissolves quickly with little turbidity, and is a fantastic prebiotic fiber. Stacking FOS with another inulin of different chain length along with soluble tapioca fiber will allow for more fiber in your formula, giving you excellent gelling where it stabilizes whatever potential gastro-intestinal that may occur from too much dietary fiber. You will see a lot of this fiber stacking in many of the up and coming “better for you” beverages.

FOS

Most of what I needed to say about FOS is in the inulin paragraph. Icon Foods is well stocked and well positioned with FOS. The price is particularly good and can save manufactures money compared to inulin. One of the best value propositions of FOS is labeling. It shows up well on the NFP and also gives you flexibility on the ingredient statement. When called out as prebiotic fiber or even FOS because when the market eventually shifts you can go back and forth to inulin and FOS without having to change all your packaging. Something to consider when picking your fibers.

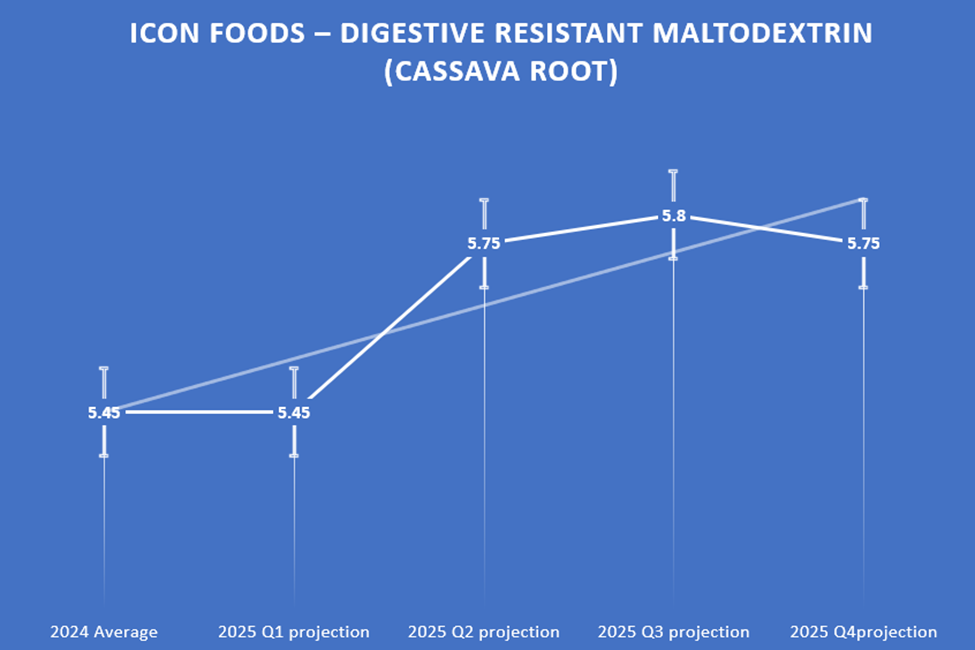

Soluble Tapioca Fiber

Soluble tapioca fiber remains the gold standard for fiber from Icon Foods’ perspective. The price will not be driven up by the corn market. Icon Foods’ FibRefine blend is not manufactured in China, thus not subject to the 25% tariff and any other additional tariffs that will occur in January 2025. Functionally, it’s an RS4 resistant dextrose or resistant starch that adds fiber and works well in keto and low-carb products, and in applications where fiber and exceptional gelling properties are needed to contribute to mouthfeel. Icon Foods is well positioned in soluble tapioca fiber. The price is much lower than soluble corn fiber and you won’t have “corn” in your ingredient deck. As I mentioned, this is the gold stand and many functional beverage companies, and food manufacturers are migrating over the soluble tapioca fiber to get the grain-free claim. There may be slight upward pressure on cost in Q1 2025 as the demand particularly in the “better for you” beverage category starts to heat up for Spring and Summer demand along with buyers moving to non-Chinese sources.

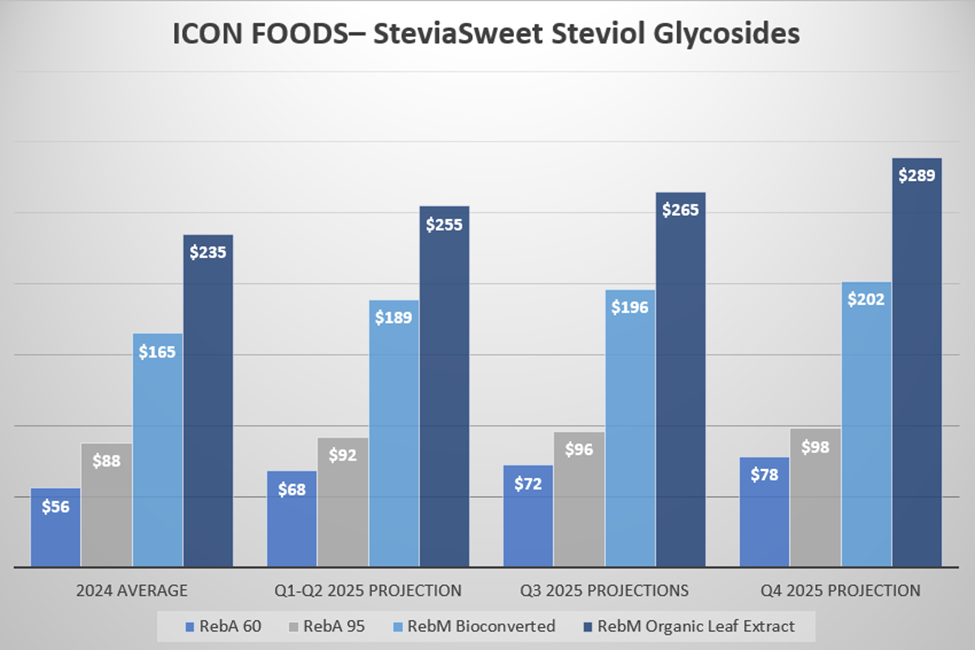

Stevia

China produces over 90% of stevia extract distributed around the world—having a finger on the pulse of this sweet commodity can really help with predictive analysis when it comes to pricing.

The stevia harvest occurred in September 2024; the harvest was strong, and the bounty of extract will likely start showing up in early Q2 2025. Prices for leaf extract will see upward pressure now through Q3 as last year’s stock gets depleted. Lock your position in now to get over the price jump.

If your need is organic leaf extract, the prudent buyer would lock their positions in through September 2025. Prices may rise in mid Q1 2025 as 2024 stock is depleted and tariffs start kicking in.

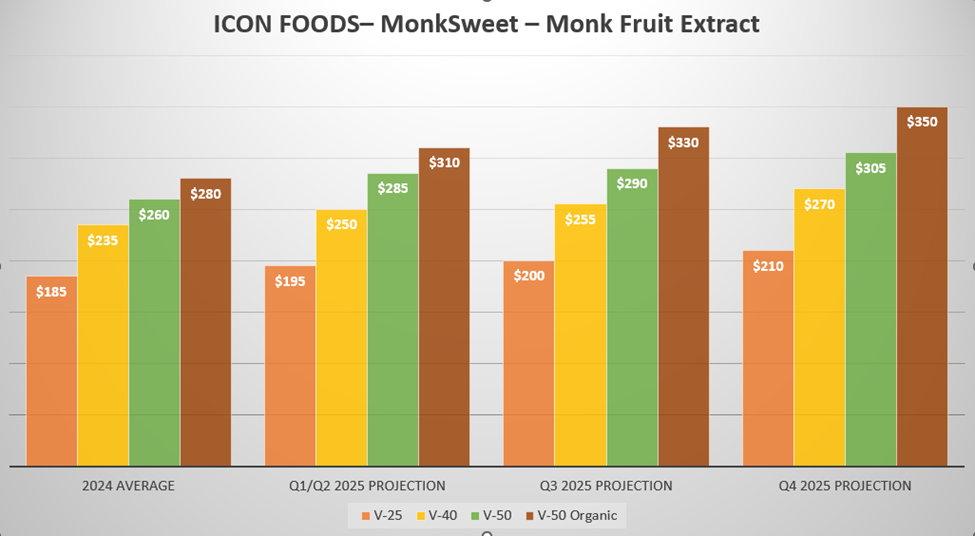

Monk Fruit

In the past months, the Monk Fruit Extract market prices have risen due to the short supply and the increased demand in the Chinese domestic market, currently few suppliers could offer enough product causing shortages on some specs.

Over the next 2-3 months monk fruit prices will rise 23-28% and maybe a little more with bigger increases as stock is depleted and tariffs start applying to Chinese material.

Something happened over the Autumn of 2024 in the monk fruit market. According to an article in Food Navigator [13] monk fruit decoctions are no longer classified as a novel food across the European Union, now the final country has scrubbed the ingredient from its list.

The Food Safety Authority of Ireland FSAI, Ireland’s food safety regulator, has deemed monk fruit decoctions are no longer novel. Ireland was the last EU member state to make the approval.

Monk fruit decoctions are different from monk fruit extract sweeteners, which are considered a food additive and which there is currently no approval for in the EU or UK. Let me explain, monk fruit juice concentrate can be used as a food ingredient in food products. This is in alignment with Health Canada. Monk fruit extract is not allowed. Since both the juice concentrate and the extract use the same substrate, this will increase demand for the juice which will put upward pressure on pricing from both the concentrate and extract globally. This upward pressure and upcoming tariff have been built into the graph below. Secure your 2025 positions now to avoid sticker shock later in the year.

Summary

Cocoa prices soared on the last day of 2024. Crop production concerns in West Africa fueled fund buying of cocoa futures after Côte d’Ivoire and Nigerian cocoa farmers reported that cocoa trees are beginning to suffer the effects of the seasonal dry and dusty Harmattan winds, with leaves turning yellow and the cherelles (cocoa pods) withering. If you need chocolate, 2025 could be brutal. We are exploring options.

On a more optimistic side, consumers are significantly savvier about what they are putting in their mouths. Consumer adoption of GLP-1 agonists has caused a shift in ultra processed food sales. Walmart pulled back on processed food revenue that nearly matches market adoption of GLP-1’s. Conagra and Nestle, amongst others, are using front of pack to identify products that support users of GLP-1 drugs. This category will continue to build. If the big guys are on it there must be something there.

The market is wide open and rife with opportunity for those courageous who are ready to jump in. If you thought Keto was big, GLP-1 will dwarf that trend. Icon Foods is here to help with our sweeteners, sweetening systems, sweetness modulators fibers and inclusions all designed to make deep clean cuts to added sugars and make your nutritional fact panel shine. Icon spells innovation.

From my vantage point, consumer spending is on the rise. The economy has not been this vibrant in a decade, jobs are plentiful and there is a stir in innovations. Most of these innovations are trying to get ahead of consumer demand and trends.

The only thing standing in the way is uncertainty; middle east strife, war in Ukraine, port congestion from buyers front-loading procurement, and the 500-pound gorilla in the room, the new tariffs that have been promised to be put into place.

Icon Foods wants to be your partner through this. At present, we are well positioned on all specs. It’s up to you to lock them in.

Thank all of you for your kind comments regarding my last market intelligence report. That means a lot but, what would mean even more is if you told me what I can do better and how Icon Foods and I can be a resource for you.

Thank you for your continued support.

Sources

[1] https://www.forbes.com/sites/claudiaalarcon/2024/12/30/these-are-whole-foods-markets-top-10-food-and-beverage-trends-for-2025/

[2] https://progressivegrocer.com/krogers-food-predictions-provide-unique-look-whats-store-2025

[3] https://finance.yahoo.com/news/november-cpi-inflation-data-meets-forecasts-cementing-fed-rate-cut-bets-134938502.html

[4] https://www.cnbc.com/2024/12/11/cpi-inflation-november-2024-annual-inflation-rate-accelerates-to-2point7percent-in-november-as-expected.html

[5] https://www.cbsnews.com/news/jobs-report-november-2024-hiring-rebound/

[6] https://www.bea.gov/news/blog/2024-12-19/gross-domestic-product-third-estimate-corporate-profits-revised-estimate-and

[7] https://farmpolicynews.illinois.edu/2023/12/ft-low-corn-prices-heap-pressure-on-farmers/

[8] https://www.freightwaves.com/news/container-imports-to-surge-ahead-of-strike-tariffs-nrf-predict

[9] https://www.bloomberg.com/news/features/2024-12-26/trump-tariffs-how-importers-shippers-worldwide-are-preparing

[10] https://www.foreignaffairs.com/united-states/how-tariffs-can-help-america

[11] https://www.usitc.gov/secretary/fed_reg_notices/701_731/701_751_notice12132024sgl.pdf

[12] https://harris-sliwoski.com/chinalawblog/new-ad-cvd-petitions-erythritol-from-china/