By Kash Rocheleau and Thom King

We appreciate your continued interest and loyalty in returning to read our thoughts on what’s happening in the industry. Before we dive in, allow me to introduce myself. I’m Kash, and I’ve had the pleasure of being part of the Icon team for nearly eight years, serving in our finance department until last June, when I stepped into the role of CEO.

For years, Thom has infused Icon’s Market Intelligence Report with his signature style—full of personality, depth, and insight. This quarter, we’re joining forces to take it to the next level, adding another layer of flavor and spice. As anyone in the culinary world knows, layering is key to creating something truly exceptional, and that’s exactly what we aim to do.

With his flavor and my spice, we think you’re in for a fun and dynamic read—one that will leave you craving next quarter’s edition before this one even ends.

Let’s dig in!

What’s Hot and What’s Not

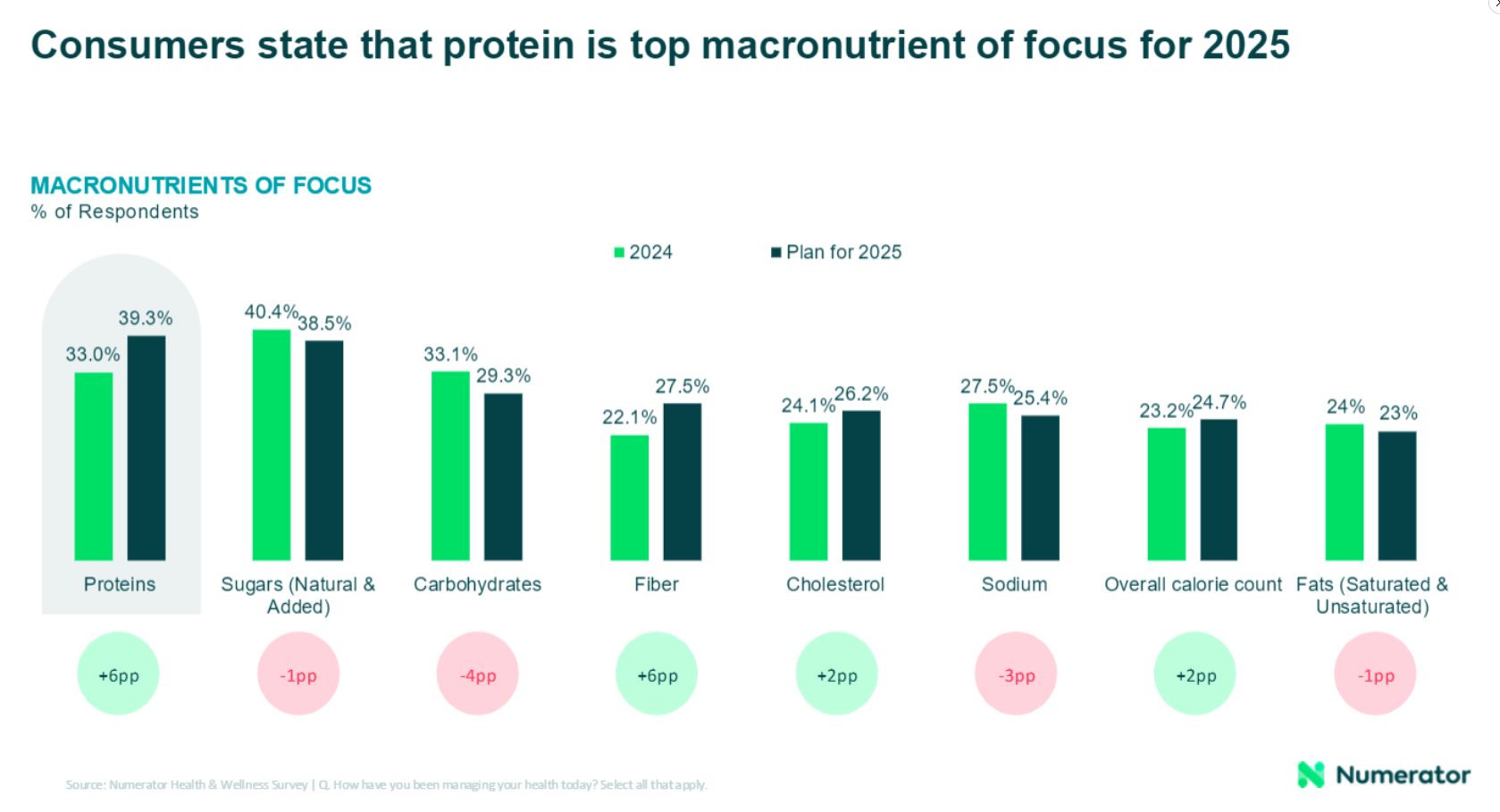

Last month, Natural Products Expo West took over Anaheim, CA, and two trends absolutely dominated: the insatiable demand for protein and the explosion of better-for-you beverages—especially when those two worlds collide. According to a presentation by Numerator and Chomps at the show, more than a third of snacks now make protein callouts, which has been a huge growth driver. Between 2019 and 2024, brands like Quest (which helped build Icon Foods) saw an 85% increase, Skinny Dipped jumped 94%, and Chomps skyrocketed 137%. The data suggests this isn’t a passing trend—protein is here to stay, with a third of consumers prioritizing it in 2024 and that number climbing to 39.3% in 2025.

Source: Numerator

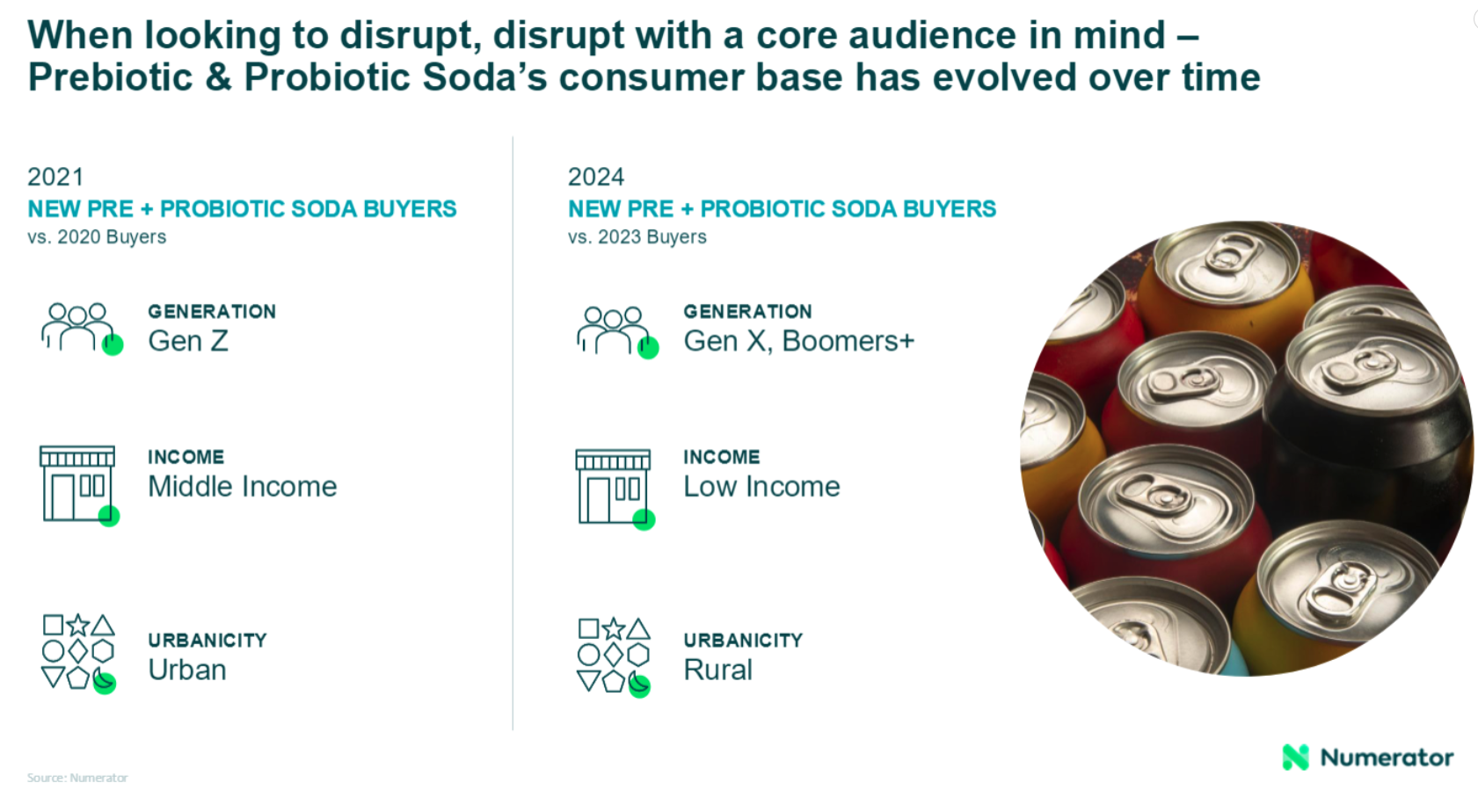

And the sugar reckoning? Still in full force. Sugar consumption has skyrocketed from just 4 pounds per person in 1900 to over 150 pounds today, and brands are scrambling to find ways to cut back without sacrificing taste. Functional sweeteners like allulose, monk fruit, and prebiotic fiber-based alternatives were everywhere, while others leaned into naturally lower-sugar formulations. With “added sugar” now broken out on Nutrition Facts labels, brands are taking different approaches—some swapping in fruit or fruit juice, others making “no artificial sweeteners” claims alongside reduced-sugar messaging. Nowhere is this shift more obvious than in beverages. Gut health is booming, sugar and calorie reduction remain key, and, of course, flavor and fun still reign supreme. Some standouts? Bloom, Poppi, and Olipop, who continue to pave the way for a wave of new entrants trying to carve out their own space. The competition is fierce, and brands are leaning into bold branding, real fruit juice, and functional benefits to stand out. One fun throwback? Slice, bringing that nostalgic soda feel with a health-forward twist.

Source: Numerator

One thing that was definitely out? Seed oils. With RFK Jr. amplifying consumer concerns about their role in inflammation—and geopolitical tensions tightening supply chains for key ingredients like sunflower oil from Ukraine—brands are rethinking what they’re frying chips in or using as the base for dressings. Out like sugar they say.

Tariffs

If you haven’t heard the word tariffs lately, I’d have to ask—have you been living under a rock? Like many of you, I was hoping that with the new administration, we’d finally get some clarity. And by clarity, I don’t mean a debate over whether tariffs are happening—I mean clear signals on the moves businesses need to start making to adjust.

Of course, in a perfect world, we’d all love to see no tariffs at all. But let’s be real—the likelihood of that happening is slim, given the administration’s stance.

While uncertainty still looms, we do have a few more answers. Since 2017, we’ve been dealing with a 25% tariff on goods from China. Shortly after the inauguration, that jumped by another 10%, and by the first week of March, yet another 10% was added—bringing the total tariff rate on most Chinese imports to a staggering 45%. And as if that weren’t enough, we’re now seeing the early signs of a trade war with Canada and Mexico.

What Does this Mean for You?

It means that goods are coming into the country at a higher cost—and those costs ultimately get passed down.

What Can Be Done to Mitigate these Costs?

There are a few strategic moves businesses can make:

- Partner with Those in Your Supply Chain – And by partner, I mean really sit down and have frank conversations about your needs. Work closely with suppliers to build accurate forecasts and plan ahead.

- Hedge Against Uncertainty – Since we don’t know how high tariffs may go—or whether we’ll see reciprocal tariffs—getting ahead of the curve by hedging costs now can help mitigate future price hikes that are already trickling down the pipeline.

- Diversify Your Sourcing Strategy – In these conversations, explore alternative sourcing options from countries that currently have lower or no tariffs (for now). Being proactive in shifting suppliers could help soften the financial blow.

In a landscape where change is the only constant, adaptability is key. The businesses that think ahead and take action now will be the ones best positioned to weather the storm.

GLP-1s: The Disruptor No One Saw Coming

Aside from tariffs, GLP-1s have quickly become the next big thing, and they’re shaking up everything from retail profits to food choices. These appetite-suppressing powerhouses, like Ozempic and Wegovy, were originally developed for type 2 diabetes but have since taken the weight-loss world by storm. And while the conversation started around individual health, the ripple effects are hitting the food industry hard.

Retailers are Feeling the Impact

It’s no secret that GLP-1 users are eating less, but what’s even more interesting is how their food choices are shifting. These users aren’t just cutting back on snacking—they’re prioritizing satiety, gravitating toward high-fiber, protein-packed options instead of mindlessly grazing. That shift is already hitting major retailers:

- Walmart has reported a “slight pullback” in spending on snacks and processed foods, thanks to GLP-1 users changing their eating habits [1].

- Kroger has seen similar declines in snack sales, prompting food manufacturers and retailers to rethink their product mixes [2].

- Households with at least one GLP-1 user have cut their grocery spending by 5.5% within six months, equating to an annual $416 reduction per household. Higher-income households? They’ve dropped an even steeper $690 per year [3].

CPG Brands are Pivoting Fast

Food brands aren’t sitting back and waiting to see how this plays out—they’re already shifting strategies to cater to a consumer base that now wants foods that promote fullness rather than just mindless indulgence.

- We’re seeing a rise in high-fiber, protein-rich snacks and meals, all designed to keep people feeling fuller, longer.

- Even new innovations are emerging—brands like NotCo are working on botanical GLP-1 boosters that could be added to everyday foods, giving consumers a more accessible and affordable way to regulate appetite [4].

The Million-Dollar Question: Are GLP-1s Here to Stay?

Now, let’s get real—is this a permanent shift in consumer behavior or just another flash-in-the-pan weight loss fad? The answer is a little complicated.

- Side effects are a real concern—nausea, constipation, and even lean muscle loss have raised red flags, and experts are still debating whether long-term use is truly sustainable [5].

- Discontinuation rates are high—many users quit before reaching meaningful weight loss, meaning the long-term adoption of these drugs could be lower than expected [6].

- Advancements in treatment could solidify GLP-1s as a long-term player—42% of previous users say they’d return to these medications if the costs and side effects improved. That means if companies crack the code on safer, more affordable options, GLP-1s could be sticking around for good [7].

Final Takeaway? Adapt or Get Left Behind

GLP-1s aren’t just a pharma success story—they’re redefining how Americans eat, and the food industry is scrambling to keep up. While the long-term future of these drugs is still up for debate, one thing is clear: consumer demand for satiety-focused, healthier foods is growing. Brands and retailers that pivot early will be the ones who win in this new food landscape.

Stay tuned—because this trend isn’t fading anytime soon in my honest opinion.

Cargill AD/CVD

One thing you may not have heard much about—or be as familiar with—is the Anti-Dumping (AD) and Countervailing Duty (CVD) suit that Cargill filed on December 13, 2024.

Following the filing, importers and distributors were given the opportunity to voice their stance via a lengthy questionnaire sent out by the International Trade Commission (ITC). Responses were due by December 27 for a hearing held on January 3. In that hearing, the ITC determined that there was enough evidence to support an AD case (and let’s be honest, it’s extremely rare for them to rule otherwise). From there, the case moved to the Department of Commerce (DOC) for its initial review.

What is Anti-Dumping (AD) and Countervailing (CVD)?

- Anti-dumping (AD) occurs when a foreign country sells goods in another country below market value due to subsidies such as tax breaks, low-interest loans, or direct financial aid. To counteract this, AD rates (essentially import fees similar to tariffs) are applied to bring prices in line with local market values.

- Countervailing Duty (CVD) duties offset those subsidies to level the playing field, ensuring goods enter the market fairly. While AD and CVD are separate, they are typically investigated together.

Now for the ‘Fun’ Part (Yes, that’s Sarcasm)

Cargill has requested a retroactive period for this investigation starting March 4, 2025. This means that any importer of record for erythritol from March 4 until a final determination is made will be subject to additional fees—whatever those may be.

The next big date to mark on your calendar is May 22, when commerce will make its initial determination. But don’t worry if you forget—we’ll keep you informed every step of the way.

With this retroactive phase in full effect, no one is currently importing erythritol, which is already driving up prices on erythritol and erythritol-based products while tightening domestic inventory.

Where We Stand and What it Means to You

We are actively fighting this petition because Cargill does not supply a non-GMO or organic erythritol option—a significant gap in the market. The total U.S. erythritol market is valued at approximately $224M, and Cargill currently supplies about 70% of it. In our view, this move creates unnecessary stress and additional burdens on businesses that rely on erythritol when there is more than enough market share to go around.

What Should You Do Now?

- Have Honest Conversations with Your Supply Chain Partners – Ask them what they are doing to secure supply and mitigate costs in light of this situation.

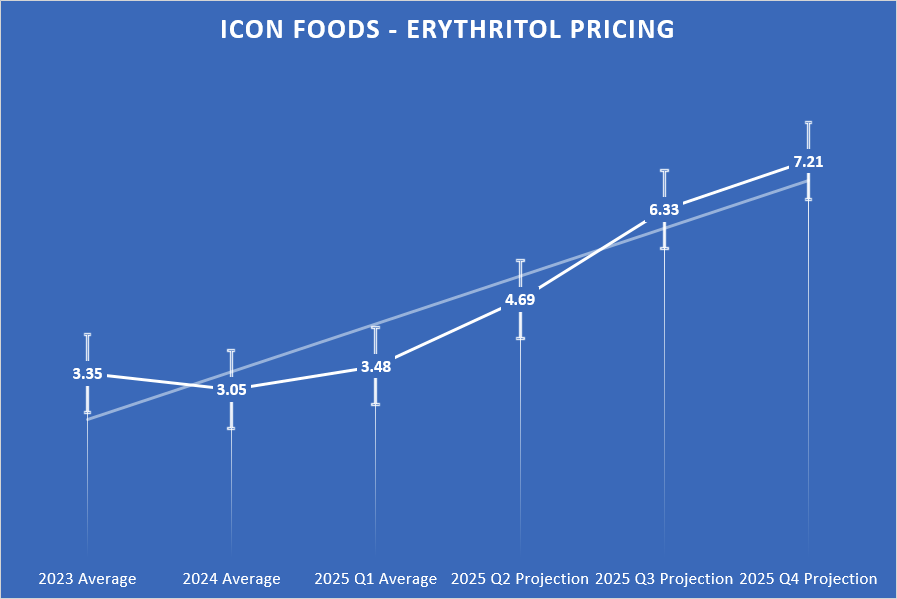

- Understand Market Pricing – In Cargill’s petition, they claim erythritol’s market value is $7.21/kg. However, word around the industry suggests they are offering “take-or-pay” contracts at around $3.48/kg.

- Protect Yourself Legally – If you’re considering signing a supply contract, make sure your legal team or an attorney experienced in these agreements reviews it first. The wrong terms could financially devastate your business.

How Icon Foods is Supporting You

If you’re feeling uncertain, take a breath—Icon Foods is well stocked and actively working on strategic solutions for every customer willing to have open, collaborative discussions. Our priority is ensuring you have the supply and support you need to navigate these challenges.

We’ll continue to keep you updated as this situation unfolds. Stay informed, stay proactive, and let’s tackle this together.

MAHA, HAHA or NAH: Is RFK Jr. About to Flip the Food Industry on its Head?

What’s the deal with the Make America Healthy Again (MAHA) initiative? RFK Jr.’s appointment has set the stage for some big shake-ups in U.S. health policy and has struck terror in the purveyors of highly processed foods. Just recently Bobby Jr. met with top food industry leaders, including the CEOs of PepsiCo North America (Steven Williams), Kraft Heinz (Carlos Abrams-Rivera), General Mills (Jeff Harmening), Tyson Foods (Donnie King), WK Kellogg (Gary Pilnick), and JM Smucker (Mark Smucker), along with reps from the Consumer Brands Association (CBA).

A leaked internal memo from the CBA made Kennedy’s message crystal clear: he’s demanding real change, pushing companies to clean up their ingredient lists. His top priority? Getting rid of artificial dyes. While he didn’t lay out specific penalties, his strong stance sent shockwaves through the industry, rattling markets and putting immediate pressure on brands to take action. Interestingly, there was quite a bit of stock movement by executives ahead of this meeting. Just a coincidence?

Let’s be honest, isn’t it about time? For years, we’ve watched ultra-processed foods dominate the shelves, sugar sneak its way into nearly everything, and regulatory loopholes allow questionable ingredients to fly under the radar. But if Kennedy gets his way, that’s all about to change.

One of the biggest targets? The FDA’s Generally Recognized as Safe (GRAS) rule—or as some might see it, the ultimate regulatory loophole.

Currently, companies can self-certify ingredients as safe, allowing new additives to enter the market without public oversight. This means most consumers have no idea what’s actually in their food. Kennedy’s proposal aims to change that.

Under his plan, food manufacturers would be required to publicly notify the FDA and submit safety data before introducing new ingredients. This added step would bring greater transparency and accountability, ensuring that food safety isn’t left in the hands of the very companies selling these products.

There’s a trade-off. This move could significantly slow down innovation in the industry, potentially delaying the introduction of new food technologies and ingredients.

This could increase R&D costs and delay product launches, particularly for companies relying on novel ingredients or functional additives. Additionally, this will slow down innovation, especially in areas like plant-based foods, alternative proteins, and functional beverages.

The issue that should raise the hair on the back of one’s neck is the retroactive potential that lies in the reevaluation of existing GRAS ingredients like allulose, stevia, monk fruit extract, most novel fiber sweeteners, preservatives, emulsifiers and a litany of ingredients that are being commonly used today. The FDA has not issued a GRAS certification in over 10 years. I am sure you can see what kind of dumpster fire this will create. In defense of Self-Affirmed GRAS, Icon Foods has been through the process, and it is not as easy as one might think. Toxicology studies must be done along with proven usage and safe levels thereof. All of this is tightly reviewed by the FDA before they release a letter of “No Objection.” This juice is not worth the squeeze when there are so many other low hanging fruit. There must be a sensible line drawn between safety and progress.

Part of the easy pickin’s come from Kennedy’s holistic approach to combating the American health crisis focused on multiple fronts. One of the biggest? Slashing sugar consumption and giving consumers real, upfront information about what they’re eating. He’s pushing for front-of-pack labeling on products high in sugar, sodium, and unhealthy fats—something that countries like Chile and Mexico have already implemented with noticeable success. The goal? Make it crystal clear which foods are loaded with junk so consumers can make more informed choices without even having to turn the package around.

For those who think this is just another round of “eat healthier” rhetoric, Kennedy is bringing some real teeth to this initiative. He’s putting pressure on food manufacturers to clean up their act—starting with artificial dyes and harmful additives. He’s already signaled to major food companies that they need to start eliminating these ingredients or face regulatory scrutiny. And let’s not forget, he’s not just targeting the food itself—he’s looking at the entire food system, from how products are formulated to how they’re marketed to consumers.

So, what does this mean for you? Well, if you’re in the food industry, buckle up. Change is coming, and being ahead of the curve will be key. Expect more scrutiny on ingredients, tighter labeling regulations, and a push for cleaner, more transparent food production. If you’re just trying to make better choices for yourself or your family, this could be the turning point where real change finally happens in the American food system.

The fight isn’t over, and there will be plenty of resistance from big food lobbyists (because when has there not been?). But if Kennedy follows through on these plans, we might actually see a future where what’s on our shelves is healthier, more honest, and better for everyone, albeit a little more expensive.

We’ll be keeping an eye on this as it unfolds—stay tuned, because this one is going to be big.

Recession? Inflation? Or Just an Expensive Midlife Crisis for the Economy?

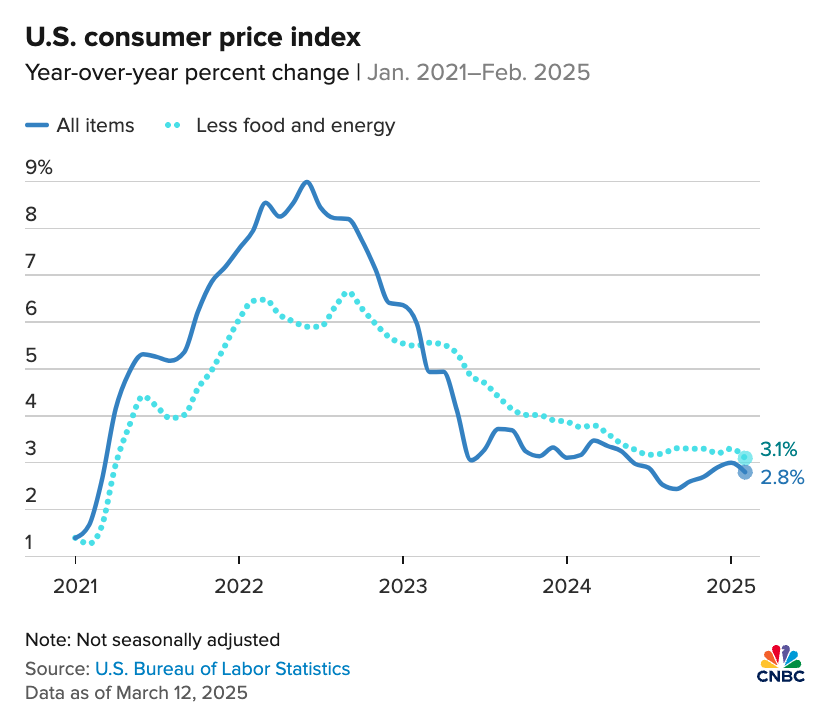

Let’s talk about inflation and the current CPI because, like it or not, it’s shaping the business landscape. As of February 2025, the Consumer Price Index (CPI) ticked up by 0.2%, signaling a bit of a slowdown compared to the heated inflation we’ve been seeing. That’s some relief, but don’t get too comfortable just yet. The Federal Reserve has been walking a tightrope, trying to keep inflation in check while balancing economic growth. And while this latest report suggests a cooling trend, plenty of pressure points could send prices climbing again.

One of the biggest wild cards? Tariffs. With the recent additions slapped on all Chinese imports, we’re staring down the barrel of another potential inflation spike. More expensive imports mean higher costs for businesses, which—let’s be real—will get passed down to consumers. Economists are already warning that this could push inflation higher in the coming months, making the Fed’s job even harder. And if inflation heats up again, rate cuts might be pushed further down the road, keeping borrowing costs higher for longer.

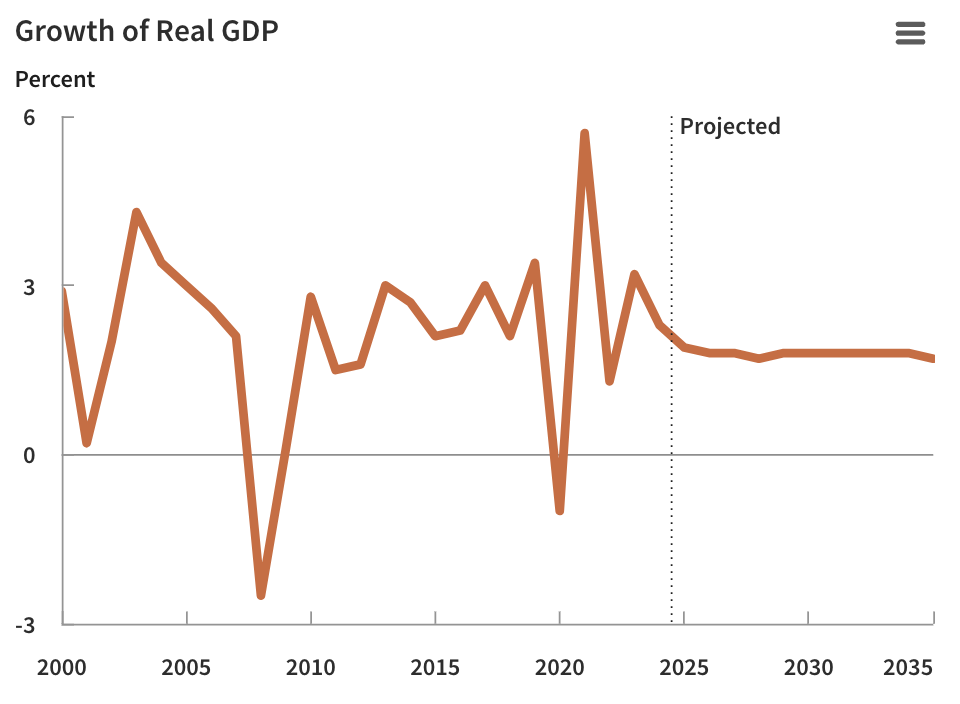

On the flip side, some forecasts still expect GDP growth to land around 1.3% for 2025, but the risk of a slowdown or even a mild recession is creeping up—especially if tariffs start dragging on business investments and consumer spending. Right now, the big question is whether inflation is truly cooling off or just taking a breather before another round of price hikes. Either way, staying ahead of these shifts will be key for businesses looking to manage costs and protect margins in what could be another turbulent year. Long story short? Keep an eye on the data, brace for potential volatility, and don’t bank on smooth sailing just yet.

Economy Says: We’re Hiring! (Terms and Conditions Apply)

Let’s talk about jobs—because whether you’re hiring, job hunting, or just keeping an eye on the economy, the employment market is shifting.

As of February 2025, the U.S. added 151,000 new jobs, which sounds good—until you realize economists were expecting 170,000. So, while we’re still seeing growth, the pace is starting to slow. That’s reflected in the unemployment rate, which ticked up slightly to 4.1% from 4.0% in January. And here’s something worth watching: job openings surged to 8.2 million (up from 7.6 million the month before), which means there’s still strong demand for workers—but it could also signal a growing mismatch between skills and available jobs.

So, where are the jobs actually showing up?

- Healthcare is still leading the pack with 52,000 new positions (no surprise there).

- Financial services added 21,000 jobs, meaning banks and investment firms are still hiring.

- Transportation and warehousing saw a boost with 18,000 new positions (logistics remains strong).

- Social assistance climbed by 11,000 jobs, likely due to increased demand in community-based services.

- On the flip side, federal government jobs dropped by 10,000, continuing a downward trend in public sector employment, much of this bullet is attributed to DOGE.

- The increase in GDP primarily reflected increases in consumer spending, exports, federal government spending, and nonresidential fixed investment.

- “The good news is that we can afford to be a little more cautious.” – Jerome Powell, Federal Reserve Chair.

And here’s something that might not be making headlines but should be on your radar: the labor force participation rate dipped to 62.4%, and the number of people working part-time for economic reasons jumped by 460,000 to 4.9 million. Translation? More people are taking part-time roles because they can’t find full-time work. That’s usually a red flag that the job market isn’t as strong as the headline numbers suggest.

Bottom line? The job market is still growing, but cracks are forming. Hiring is cooling, more people are being forced into part-time work, and the unemployment rate is creeping up. Businesses should be keeping a close eye on wage trends and workforce shifts, while job seekers might want to lock in opportunities before things get tighter.

We’ll keep watching this space—because it’s shaping up to be a pivotal year for employment trends.

Ship Happens: The Chaos and Complexity of Modern Logistics

Since our last Market Intelligence edition, logistics has cooled off quite a bit. The longshoremen have reached an agreement and wait times at both West and East Coast ports have normalized. Currently, the typical wait time for a ship to dock and unload is 1–2 days—a major improvement from previous bottlenecks.

At the end of 2024, the U.S. supply chain faced a major threat with a potential International Longshoremen’s Association (ILA) strike, which could have crippled East and Gulf Coast ports. The dispute revolved around wage increases and automation. The ILA pushed back against automation, fearing job losses, while port operators argued it was necessary for efficiency. In October 2024, over 47,000 ILA members walked off the job—the first strike of its kind since 1977. Operations halted at 36 ports, sending shockwaves through the industry.

A temporary deal paused the strike after three days, and a tentative six-year master contract was reached just days before the January 15, 2025, deadline. The final agreement included wage increases and compromises on automation, aiming to ensure that new technologies would create, not replace, jobs. Though the crisis was averted, the event underscored the fragile balance between labor, automation, and operational continuity in the logistics sector.

While this labor resolution brought some stability, the freight market overall continues to face headwinds. According to Q4 2024 freight data, the anticipated “market reboot” has been slower than expected [8]. Spot rates and tender rejections remain low, with carriers holding capacity open despitesustained losses, hoping for a market rebound. A true recovery may not materialize until mid to late 2025.

Ocean Shipping

Meanwhile, ocean container rates are showing signs of downward pressure, providing a rare bright spot for shippers. Rates out of Asia dropped below 2024 lows last week due to a combination of factors: post-Lunar New Year demand slumps, capacity growth, and the restructuring of major carrier alliances.

- Asia-Europe rates fell 11% to $2,740/FEU—14% below their 2024 floor.

- Asia-Mediterranean rates eased 9% to under $3,800/FEU.

- Transpacific rates also declined—$2,400/FEU to the West Coast and $3,500/FEU to the East Coast—already 18% below their 2024 lows.

Despite some frontloading of inventory and congestion in European hubs, pricing pressure remains. Carriers have announced April General Rate Increases (GRIs), but March attempts largely failed. Analysts expect a weaker second half of the year, especially if frontloading fades and new tariffs on imports from China, Canada, Mexico, and Europe take effect. Ocean contract negotiations are reportedly trending lower than carriers had hoped, signaling broader rate softness to come.

Air Shipping

On the air cargo side, there’s been a modest rate rebound.

- Ex-China air rates rose to $5.00/kg to the U.S. and $3.80/kg to Europe.

- Transatlantic rates hit $2.43/kg, 15% higher than at the start of the year—likely due to frontloading in anticipation of potential U.S. tariffs on European goods.

These rate movements offer an encouraging sign for shippers: there’s downward pressure on container and freight costs. For domestic shipping, however, it’s a mixed picture. As summer approaches, fuel demand is expected to rise, and with it, Less-Than-Truckload (LTL) and Full Truckload (FTL) rates could increase by 20–25%.

What Can You Do?

To hedge against rising domestic transportation costs:

- Plan inventory ahead of anticipated rate hikes.

- Consolidate orders to fill trucks more efficiently.

- Buy for multiple production runs rather than one-offs to spread logistics costs over greater volume.

A little proactive planning can go a long way in a market that remains unpredictable. While some pressures are easing, volatility remains the name of the game across both global and domestic logistics.

Source: Congressional Budget Office

Corn

Ah corn, those golden kernels of heaven-sent manna, the most abundant source of all mighty glucose, the substrate of so much. As we gaze into the tea leaves, of domestic and international supply we can see, not much. Steady as she goes. As of March 19, 2025, Chicago Board of Trade (CBOT) corn futures are trading near $4.40 per bushel just about where they were this time last year, maybe down a bit. Sweet stability, but we find that this price point is considered less attractive compared to previous years, prompting farmers to contemplate planting more corn acres to maintain profitability. More corn, lower pricing.

Future Price of Corn

The U.S. Department of Agriculture (USDA) projects that corn prices will start at $3.90 per bushel in the 2025/26 marketing year and gradually increase to $4.30 per bushel by 2029/30, where they are expected to plateau. Talk about stability in a world of chaos and uncertainty. Not great for farmers, like Cargill, but good for those downstream, including consumers. However, these projections are subject to various factors, including domestic production, global demand, and geopolitical events.

Stability of the Global Corn Supply

Global corn supplies are anticipated to tighten in the 2024/25 season. The USDA estimates that world corn ending stocks will decline to approximately 87 million metric tons, a 12-year low. This reduction is attributed to decreased production in major exporting countries and sustained global demand.

In Brazil, untimely rains have delayed the planting of the second corn crop for 2024/25, particularly in key states like Mato Grosso and Paraná. These delays heighten the risk of yield reductions, potentially exacerbating the already tight global corn supply.

USDA Projections for Domestic and Global Corn Supply (Next Three Quarters of 2025)

The USDA forecasts a record U.S. corn crop for the 2025/26 marketing year, projecting production to reach 15.585 billion bushels. This increase is expected to boost ending stocks to 1.965 billion bushels, resulting in a stocks-to-use ratio of 12.9%.

Despite this anticipated record production, global corn supplies remain under pressure. The Food and Agriculture Organization (FAO) projects that global cereal stocks will decline by 1.9% by the end of 2025, bringing the stocks-to-use ratio down from 30.9% in 2023/24 to 29.9% in 2024/25. This decrease suggests a tightening global supply situation.

While domestic corn production in the United States is expected to reach record levels in the 2025/26 marketing year, global corn supplies are projected to tighten due to reduced production in other key regions and sustained demand. These dynamics are likely to influence corn prices and market stability over the next three quarters of 2025, driving up prices and contributing to upward pressure on foreign produced derivatives like erythritol and allulose. Stakeholders should monitor these developments closely to navigate the evolving landscape of the corn market effectively. Since you have Icon Foods by your side, we will do that for you.

Erythritol

I touched on the Cargill anti-dumping case earlier in this report, but it’s important to reiterate the impact—with no importing happening, we’re seeing upward pressure on costs and a contracting market.

At Icon Foods, we are doing everything we can to mitigate these challenges by absorbing costs where possible to minimize the impact on our customers, all while ensuring we remain profitable enough to sustain operations.

Thom mentioned in the last report that we were bracing for costs in the high $3s to mid $4s per kg, and so far, that projection is tracking accurately as the market continues to shift. However, with the anti-dumping and countervailing duties (AD/CVD) that Cargill has pushed forward, we need to adjust our expectations. If this goes through, we should be bracing for prices closer to $7.20/kg, which would have a major impact on cost structures and sourcing strategies. Now is the time to start planning for potential price hikes and securing supply ahead of these shifts.

The bottom line? Icon Foods is well-positioned on erythritol and fully committed to helping our customers weather this storm. We’re here to support and strategize through these volatile market conditions.

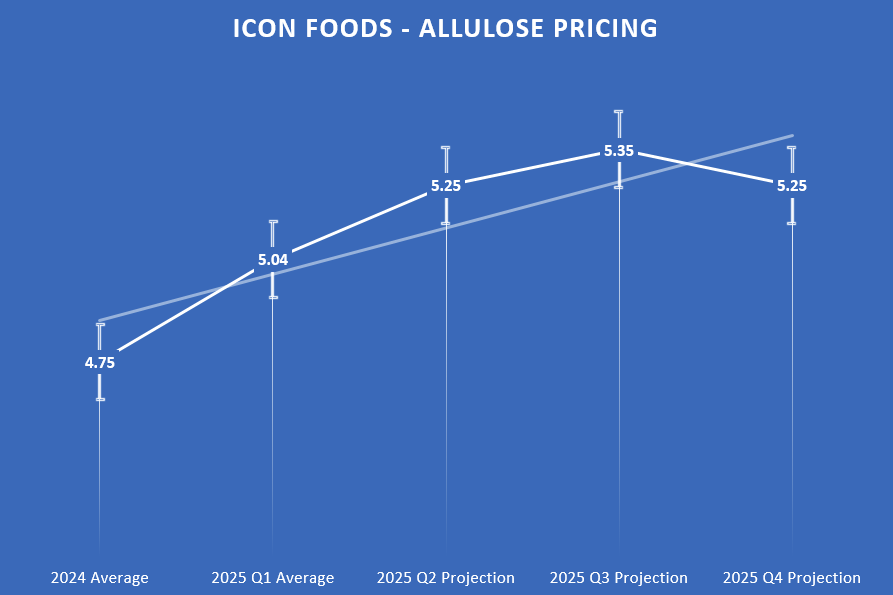

Allulose

The U.S. allulose market has experienced significant growth, driven by increasing health consciousness and demand for low-calorie sugar alternatives. In 2024, the market was valued at approximately $276.41 million, with projections indicating a Compound Annual Growth Rate (CAGR) of 13.91% between 2025 and 2033 [9]. This surge is attributed to consumers seeking healthier options and food manufacturers incorporating allulose into baked goods, dairy items, sauces, and snacks.

Current Market Pricing and Challenges

As of March 2025, allulose pricing remains higher than erythritol, making it a costly alternative for large-scale production. Currently, the market is bearing prices between $4.25/kg and $6.00/kg. While allulose is more expensive than erythritol today, that may not be the case for long given the volatility surrounding erythritol, including anti-dumping cases and supply chain disruptions. As the market continues to shift, allulose could become a more competitive option in the near future.

However, despite its growing popularity, allulose faces significant barriers to widespread adoption. Whole Foods has banned allulose from its stores, classifying it as an “unacceptable ingredient” due to concerns over its classification as a rare sugar and its processing methods. Additionally, allulose remains banned in the EU, as the European Food Safety Authority (EFSA) has yet to approve it for use in food products. This regulatory roadblock limits its global expansion and makes it difficult for multinational brands to formulate with it across all markets.

Get ahead of a potential supply chain restriction and possible price jump by positioning yourself through 2025. You won’t be sorry.

Below is the trend line for allulose:

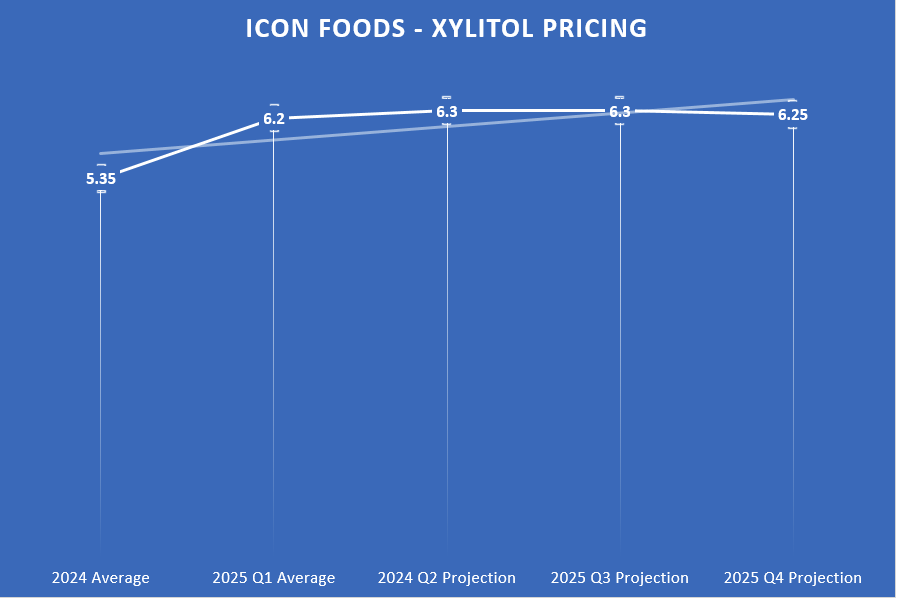

Xylitol

As of March 2025, the xylitol market is still on the rise, driven by growing demand for natural sweeteners. Recent reports show the market hit $1.04 billion in 2023, and projections indicate it could climb to $1.51 billion by 2028, with a CAGR of 7.79% [10].

But here’s where things get tricky—trade policies are shaking up the market. There are additional tariffs on imports from China, which is a major supplier of xylitol [11]. Not to be outdone, China hit back with retaliatory tariffs, imposing up to 15% on U.S. agricultural exports, making supply chains even more unpredictable [12].

So, what does this mean for you? Higher costs, potential supply chain disruptions, and pricing volatility. With tariffs on Chinese xylitol imports, expect delays and possible shortages—meaning pricing strategies and sourcing plans need to be reevaluated.

That said, demand for xylitol isn’t slowing down. More brands are making the shift toward clean-label, sugar-free alternatives, so locking in supply now is key. Call your Icon Foods representative to get ahead of these price hikes and secure your xylitol needs for 2025 before things get even more unpredictable.

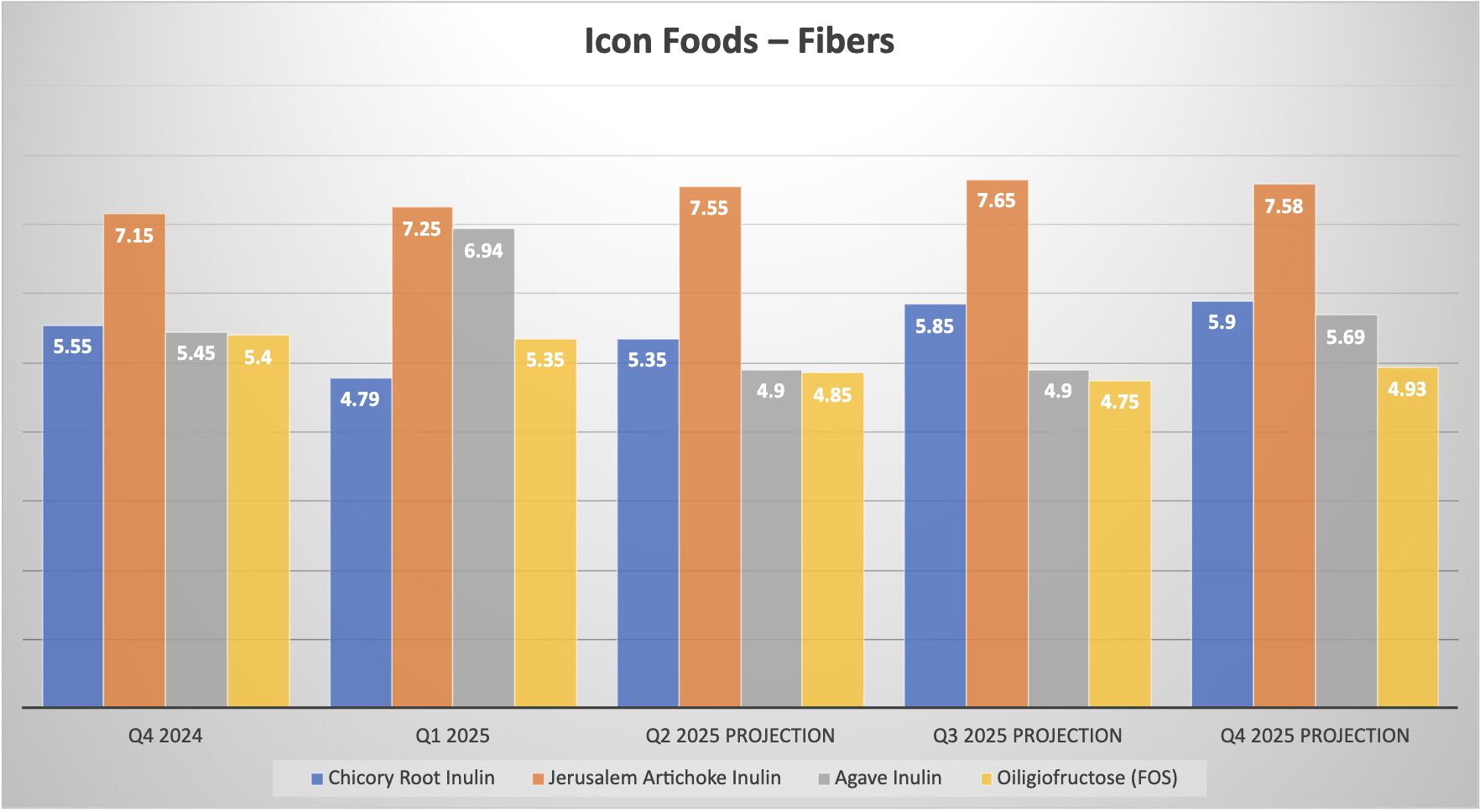

Inulin

As many of you are aware, inulin is a naturally occurring prebiotic fiber found in various plants, notably chicory root, Jerusalem artichoke, and agave. This soluble fiber passes through the small intestine undigested and ferments in the colon, serving as nourishment for beneficial gut bacteria. This fermentation process contributes to improved digestion and a healthier gut microbiome [13].

Chicory root is a primary commercial source of inulin due to its high concentration of this fiber. It’s often utilized in food production to enhance fiber content and improve texture in low-fat and sugar-free products. Similarly, Jerusalem artichoke offers a natural means to increase fiber intake while promoting digestive health. Agave, commonly associated with its use as a natural sweetener, also contains significant amounts of inulin, showcasing its versatility in food applications. However, due to inulin’s fermentation process, some individuals may experience gastrointestinal discomfort, such as bloating or gas. To mitigate these effects, a technique called stacking is advised—this involves gradually increasing inulin intake and combining it with other types of fibers to allow the gut microbiome to adjust over time [14].

Regular consumption of inulin has been linked to various health benefits, including aiding fat metabolism and blood sugar regulation [15]. However, it’s important to note that excessive intake can lead to gastrointestinal discomfort, particularly when consumed in large quantities without an adjustment period. Starting with smaller amounts and gradually increasing intake over time can help minimize these effects.

The global inulin market is experiencing significant growth, driven by increasing consumer awareness of its health benefits and a rising demand for natural and functional ingredients. Valued at approximately $1.84 billion in 2024, the market is projected to reach $3.27 billion by 2033, exhibiting a CAGR of 5.97% from 2025 to 2033. This growth is attributed to the expanding applications of inulin in the food and beverage industry, particularly in products aimed at enhancing digestive health and offering low-calorie alternatives [16].

Regionally, Europe dominates the inulin market, accounting for 42.0% of the market share in 2024. This dominance is driven by increasing consumer demand for natural and functional ingredients, rising health awareness, and the growing application of inulin in the food and beverage, pharmaceutical, and dietary supplement industries. The stable supply of chicory root, a primary source of inulin, also supports market growth in this region [17].

Inulin’s versatility extends beyond traditional food products. Its incorporation into functional beverages, such as prebiotic and probiotic drinks and health tonics, is on the rise, aligning with consumer demand for products that offer additional health benefits beyond basic nutrition. This trend not only attracts health-conscious consumers but also encourages brands to differentiate themselves in a competitive market [18].

Given the growing interest in functional foods and gut health, inulin has become a common ingredient in many products, from protein bars and yogurt to low carb baked goods and beverages. Its natural origin and multiple health benefits make it an attractive option for those looking to enhance their diet with prebiotic-rich ingredients. As demand for plant-based and functional foods continues to rise, inulin from sources like chicory root, Jerusalem artichoke, and agave is likely to play an increasingly significant role in nutrition and digestive health [19].

FOS

Most of what I needed to say about FOS is in the inulin paragraph. Icon Foods is well stocked and well positioned with FOS. The price is particularly good and can save manufacturers money compared to inulin. One of the best value propositions of FOS is labeling. It shows up well on the NFP and gives you flexibility on the ingredient statement for market shifts. When called out as prebiotic fiber, you can go back and forth between inulin and FOS without having to change packaging. Something to consider when picking your fibers.

Fructooligosaccharides (FOS) are having a moment, and for good reason. These prebiotic fibers, found in sources like chicory root and bananas, are getting a ton of attention for their gut health benefits and their growing role in functional food and beverage formulations. As the health and wellness movement continues to gain traction, FOS is riding the wave as a go-to ingredient for digestive health, low-calorie sweetening, and even infant nutrition.

The market is on the rise. In 2024, FOS was valued at $2.95 billion, and by 2025, it’s expected to hit $3.21 billion, growing at a solid 8.8% CAGR. Looking ahead, projections show the market reaching $4.45 billion by 2029, maintaining strong momentum at an 8.5% CAGR [20]. What’s driving this? A few things:

- Gut health awareness is booming, and FOS is a proven prebiotic that supports beneficial gut bacteria.

- Diabetic-friendly and low-calorie sweeteners are in high demand, and FOS checks both boxes.

- Infant formula innovation is pushing FOS forward, with brands incorporating it to mimic the benefits of human milk oligosaccharides (HMOs).

Geographically, North America currently leads the charge in FOS demand. But if you’re looking for where the real growth is happening, keep your eyes on Asia-Pacific. This region is set to be the fastest-growing FOS market as consumer interest in gut health, aging-related nutrition, and functional foods continues to climb [21].

Bottom line? FOS is on a steady upward trajectory. With continued R&D investments, product innovation, and expanding applications, this functional fiber is here to stay. Expect to see it popping up in even more food and beverage products as brands capitalize on the prebiotic boom.

Soluble Tapioca Fiber

The soluble tapioca fiber market is experiencing significant growth, driven by the increasing consumer demand for functional ingredients in food and beverages. In 2023, the market was valued at approximately $13.25 billion and is projected to reach around $29.75 billion by 2032, reflecting a CAGR of 9.2% during the forecast period [22].

A notable trend is the beverage industry’s adoption of soluble tapioca fiber, particularly in the “better-for-you” and gut health-focused beverage categories. This ingredient not only enhances fiber content but also improves texture and mouthfeel, making it ideal for applications like prebiotic sodas, protein shakes, and other functional drinks.

At Icon Foods, we recognize the importance of reliable sourcing. Unlike some suppliers, we do not primarily source our soluble tapioca fiber from China, ensuring a stable supply chain less susceptible to geopolitical tensions and tariffs. This strategic sourcing approach allows us to meet the growing demands of the beverage sector without compromising on quality or availability.

Given the market’s trajectory and the beverage sector’s increasing reliance on soluble tapioca fiber, it’s imperative to secure your supply to stay ahead. We encourage you to contact your Icon Foods representative to discuss how we can support your product development and ensure a consistent supply of high-quality soluble tapioca fiber.

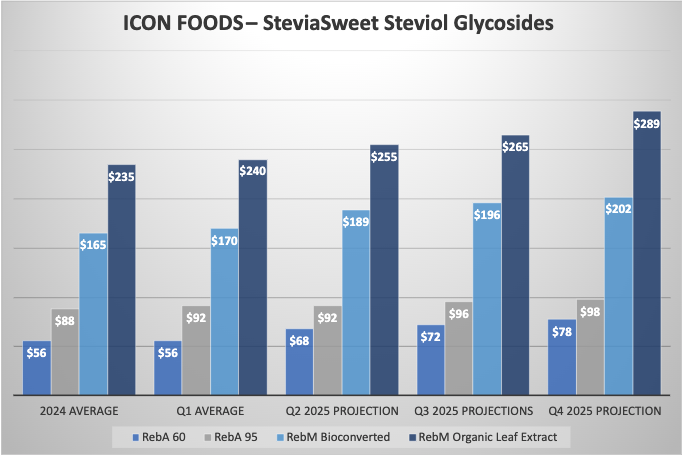

Stevia

When it comes to stevia, not all glycosides are created equal. If you’ve been keeping up with the evolution of sugar alternatives, you’ve probably heard of Rebaudioside A (Reb A) and Rebaudioside M (Reb M)—two of the most talked-about compounds in the industry. While Reb A has been the go-to for years, Reb M is positioning itself as the superior long-term option. Here’s why:

Reb A: The Old Standby (With a Catch)

Reb A is one of the most abundant steviol glycosides in the stevia plant, making up about 5% of its leaves. It’s been widely used in sugar reduction formulations because of its high sweetness—roughly 300 times that of sugar. But here’s the catch: Reb A comes with a bitter, licorice-like aftertaste that can throw off the taste profile of a product. This is why many brands have had to blend Reb A with other sweeteners to mask the off notes [23].

Reb M: The Future of Stevia?

Reb M, on the other hand, is much harder to find in nature—making up less than 0.1% of stevia leaves. But what it lacks in availability, it makes up for in performance. Unlike Reb A, Reb M delivers a clean, sugar-like sweetness with no bitterness, making it a game-changer for manufacturers looking to cut sugar without compromising flavor [24].

The challenge? Cost and scalability. Because Reb M is found in such tiny amounts in the stevia plant, traditional extraction methods weren’t viable for mass production. That’s where bioconversion and fermentation have stepped in—two innovative production methods that allow companies to produce Reb M at scale without relying solely on stevia leaves. This has drastically improved both availability and cost, making Reb M a more realistic option for the future.

The Verdict? Go Long on Reb M

While Reb A has been the industry standard for a while, its taste limitations and the need for blending make it less than ideal in the long run. Reb M, with its superior taste and growing availability, is shaping up to be the smarter bet for food and beverage brands. As production methods continue to evolve and costs come down, expect Reb M to take center stage in the next wave of sugar reduction innovation.

Stevia continues to dominate the natural sweetener space as consumer demand for healthier, sugar-free alternatives keeps growing. The market is on track to jump from $0.92 billion in 2024 to $1.03 billion in 2025, with a solid 11.6% CAGR fueling the momentum [25]. With brands shifting toward clean-label and natural formulations, it’s no surprise that stevia is front and center.

That said, there’s one big factor that could shake up pricing: China. A huge chunk of stevia production is concentrated there, and with the U.S. slapping the recent tariffs on Chinese imports, the industry is keeping a close eye on potential cost increases [26]. If you’re sourcing from China, expect higher costs and supply chain headaches—that’s just the reality of the current trade environment.

But here’s the good news: we had a strong harvest in Fall 2024, and that should carry us comfortably through Fall 2025. So while tariffs might push up pricing, we don’t foresee any additional pressure from weak harvests—which means no supply-driven price spikes in the near term. Bottom line? Tariffs are the real wildcard here, not supply shortages. Keep an eye on sourcing strategies and be ready to adjust if necessary.

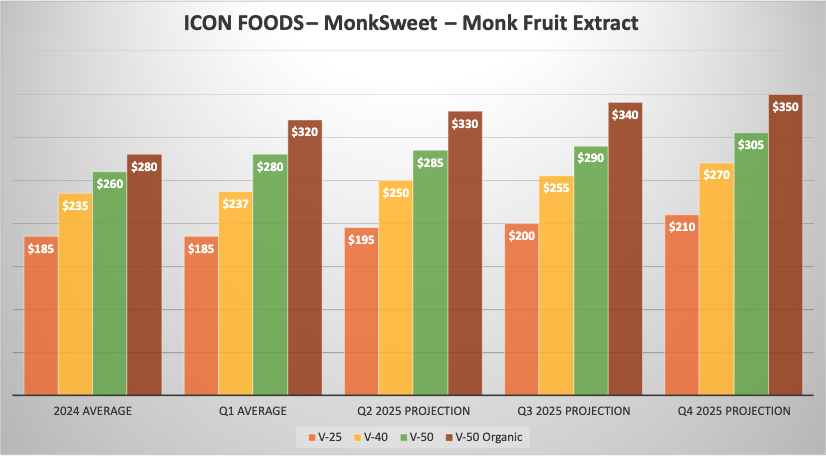

Monk Fruit

Monk fruit, being a zero-calorie, plant-based sweetener, is exploding in popularity as consumers ditch sugar and artificial alternatives in favor of clean-label, natural options. At 150–200 times sweeter than sugar without spiking blood sugar, it’s a go-to for brands looking to capitalize on the health-conscious shift [27].

The monk fruit sweetener market is booming. North America is on track for a 6.6% CAGR, driven by rising health awareness and the push for low-calorie, non-GMO, and organic products [28].

On the ingredient innovation side, monk fruit extract is benefiting from the shift away from artificial sweeteners like aspartame and sucralose. Consumers want real, natural options, and brands are taking notice. The challenge? Supply chain risks and tariffs—with the bulk of monk fruit production concentrated in China, pricing volatility remains a factor. But the demand isn’t slowing down anytime soon.

As sugar reduction remains a priority across food and beverage, monk fruit is going to keep gaining ground. The key for brands? Lock in reliable supply chains, stay ahead of regulatory shifts, and tap into the clean-label movement before the market gets even more competitive.

Cocoa

As many of you who purchase chocolate from Icon Foods or other suppliers have noticed, there has been a significant price increase. This is largely due to the cocoa market experiencing an unprecedented surge in prices, driven by supply shortages and environmental challenges. Cocoa prices have skyrocketed, surpassing $10,000 per metric ton in late 2024—a staggering 150% increase year-over-year [29]. The primary reasons behind this spike include extreme weather conditions, crop diseases, and underinvestment in cocoa farms, especially in key producing regions like Côte d’Ivoire and Ghana. For example, Côte d’Ivoire’s mid-crop cocoa output is expected to decline by about 40% due to prolonged drought, further straining supply [30].

Despite forecasts predicting a 7.8% increase in global cocoa production for the 2024/25 season, demand is projected to drop by around 4.8%, which could create a temporary surplus [31]. However, even with this increase in production, prices are expected to remain high—hovering around $6,000 per metric ton—due to the ongoing supply-demand imbalance and environmental factors affecting long-term output [32]. Chocolate manufacturers are adapting by modifying product formulations, adjusting prices, and even reducing product sizes to cope with rising costs. Companies like Hershey have acknowledged the pressure these price hikes are placing on earnings, and many in the industry are exploring ways to navigate these challenges [33].

At the same time, there is a stronger push for sustainability and traceability in cocoa sourcing. Efforts are being made to support farmers, improve agricultural practices, and ensure compliance with environmental regulations. While the cocoa market is facing a tough period, these sustainability initiatives may help stabilize the industry over time. For now, though, expect higher prices to persist as the market works through these supply challenges [34].

Final Takeaway: Adapt or Get Left Behind

If there’s one thing we’ve learned from this quarter’s market chaos, it’s that flexibility isn’t just a strategy—it’s a survival skill. Whether it’s skyrocketing cocoa prices, the erythritol supply crunch, or the looming impact of GLP-1s on consumer eating habits, the food and ingredient industries are evolving faster than ever. The businesses that thrive won’t be the ones crossing their fingers and hoping for stability; they’ll be the ones anticipating shifts and making moves before the market forces their hand.

Take tariffs, for example—love them or hate them, they’re not going anywhere anytime soon. If companies don’t start exploring alternative sourcing, locking in supplier contracts, or hedging costs now, they’ll be playing catch-up when prices inevitably spike again. The same goes for sweeteners. Erythritol is caught in a legal battle, allulose is facing supply and regulatory hurdles, and xylitol is under tariff pressure. Betting on a single ingredient without a backup plan? That’s a risky game.

Then there’s the consumer shift toward satiety-focused eating. Thanks to GLP-1s, the era of mindless snacking is fading, and brands that double down on high-protein, high-fiber, functional foods will be the ones leading the charge. Meanwhile, the FDA is under increasing pressure to crack down on ultra-processed foods and clean up the GRAS loophole. If regulatory changes roll out, companies that have already prioritized transparency and better-for-you formulations will be ahead of the curve—while others scramble to catch up.

At the end of the day, waiting for market conditions to stabilize isn’t a plan. The only constant is change, and the companies that succeed will be the ones staying ahead of trends, diversifying strategies, and adapting in real-time. Because in this industry, if you’re not evolving, you’re already falling behind.

Icon Foods wants to be your partner through this. At present, we are well positioned on all specs. It’s up to you to lock them in.

Thank you for your continued support.

Kash and Thom

Disclaimer

The opinions expressed in this newsletter are solely those of Icon Foods and do not necessarily represent the views of any affiliated parties. While we make every effort to ensure that the information provided is accurate and current, we cannot guarantee its completeness or reliability. Icon Foods is not responsible for any inaccuracies, errors, or omissions contained herein, nor for any consequences that may result from the use of this information. Readers are encouraged to conduct their own research and verification before making decisions based on the content provided.

Sources

[1] https://www.dbbnwa.com/articles/glp-1-weight-loss-drugs-impact-retail-sectors/

[2] https://www.linkedin.com/news/story/food-industry-eyes-ozempic-effect-5794284/

[3] https://www.fooddive.com/news/glp-1-drug-use-cuts-grocery-spending-by-6-study-finds/736313/

[4] https://nypost.com/2025/03/13/health/new-glp-1-booster-can-be-added-to-any-food-for-weight-loss/

[5] https://www.wsj.com/health/wellness/ozempic-weight-loss-drug-aging-health-benefits-d93a22f8

[6] https://jamanetwork.com/journals/jamanetworkopen/fullarticle/2829779

[7] https://www.pwc.com/us/en/services/consulting/business-model-reinvention/glp-1-trends-and-impact-on-business-models.html

[8] https://www.freightwaves.com/news/q4-freight-data-shows-market-reboot-slower-than-anticipated

[9] https://www.gminsights.com/industry-analysis/allulose-market

[10] https://www.globenewswire.com/news-release/2024/07/02/2907236/28124/en/Xylitol-Global-Market-Opportunities-and-Strategies-to-2033-Focus-on-Ultrasound-Assisted-Fermentation-in-Xylitol-Production-to-Reduce-Waste-Oat-Derived-Xylitol-for-Diverse-Applicati.html

[11] https://www.whitehouse.gov/fact-sheets/2025/02/fact-sheet-president-donald-j-trump-imposes-tariffs-on-imports-from-canada-mexico-and-china/

[12] https://www.reuters.com/world/china/china-vows-countermeasures-against-us-tariffs-linked-fentanyl-2025-03-04/

[13] https://www.healthline.com/health/food-nutrition/top-inulin-benefits

[14] https://www.webmd.com/vitamins/ai/ingredientmono-1048/inulin

[15] https://www.healthline.com/health/food-nutrition/top-inulin-benefits

[16] https://www.imarcgroup.com/inulin-market

[17] https://www.imarcgroup.com/inulin-market

[18] https://www.futuremarketinsights.com/reports/inulin-market

[19] https://www.inspiredbyinulin.com/

[20] https://www.thebusinessresearchcompany.com/report/fructooligosaccharides-global-market-report

[21] https://www.thebusinessresearchcompany.com/report/fructooligosaccharides-global-market-report

[22] https://datahorizzonresearch.com/soluble-tapioca-fiber-market-8285

[23] https://baynsolutions.com/en/how-to-choose-between-reb-a-and-reb-m/1116861

[24] https://www.steviaworld.ca/rebaudiosides

[25] https://www.thebusinessresearchcompany.com/report/stevia-global-market-report

[26] https://www.wsj.com/business/the-day-trumps-tariff-threats-became-a-reality-for-america-inc-e6d2a840

[27] https://www.wellandgood.com/food/monk-fruit-sweetener-trend

[28] https://www.grandviewresearch.com/industry-analysis/monk-fruit-sweetener-market-report

[29] https://www.investopedia.com/rising-cocoa-prices-on-the-cost-of-sweets-8756159

[30] https://www.reuters.com/markets/commodities/ivory-coasts-mid-crop-cocoa-output-expected-drop-around-40-due-long-drought-2025-03-18/

[31] https://www.icco.org/february-2025-quarterly-bulletin-of-cocoa-statistics/

[32] https://uk.finance.yahoo.com/news/cocoa-commodities-rally-2025-125244018.html

[33] https://www.foodbusinessnews.net/articles/27654-cocoa-prices-impacting-hersheys-2025-forecast

[34] https://farmforce.com/articles/navigating-the-2024-2025-cocoa-season-market-dynamics-and-the-imperative-of-traceability/